The Investor Gold Rush to Legal Technology

Mark Cuban has put money into legal technology investments. So has Kobe Bryant. And a number of other celebrity investors. What’s it mean? That legal technology is on the verge of a tipping point.

LawFuel.com hit on this in a recent post, Why Big Name Investors Like Mark Cuban & Kobe Bryant Are Investing in Legal Tech. The fact these “name” investors are putting their money into legal technology startups and other associated ventures is evidence of a pattern that’s been seen before in technology segments: When a particular tech sector seems ready to catch fire and gain broad traction, investors begin flocking to it, lest they miss out on the potential gold rush.

Money is on the hunt for the Next Big (Tech) Thing

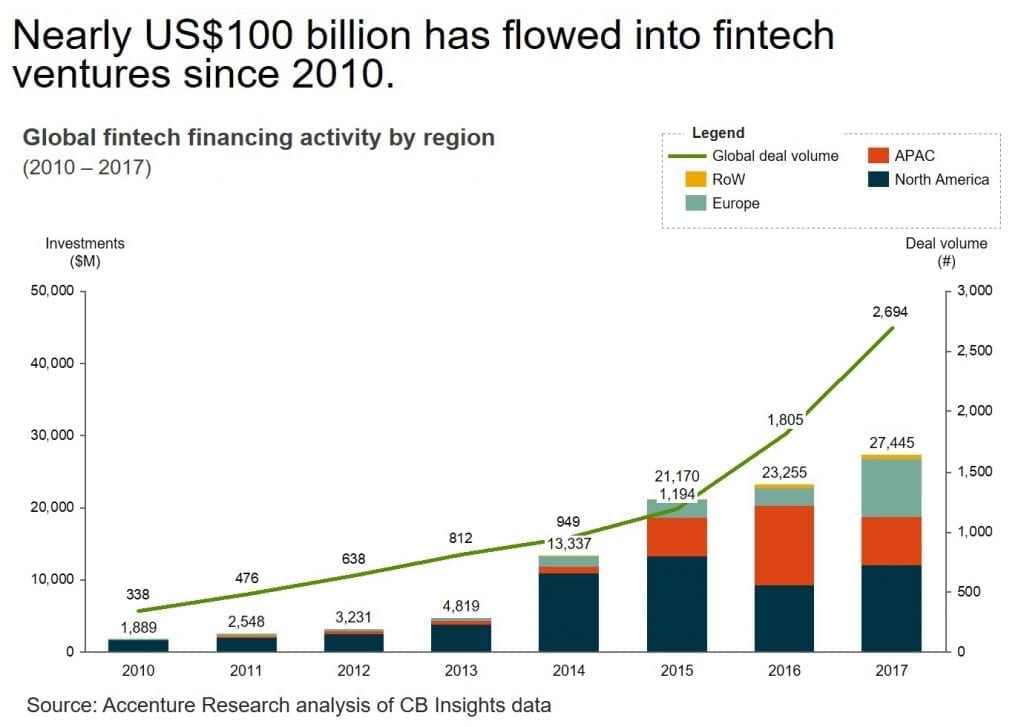

Here’s an example of recent vintage. Investment in financial industry technologies, from mobile payment apps to enterprise banking platforms, took off in the last few years.

It was certainly driven by the very visible success of PayPal, Square, even Quicken and others. Institutional investors worldwide, not just VCs, began to take notice. As Accenture put it, this underscored “continued appetite from investors scouring the globe for innovation in insurance, banking and capital markets start-ups.”

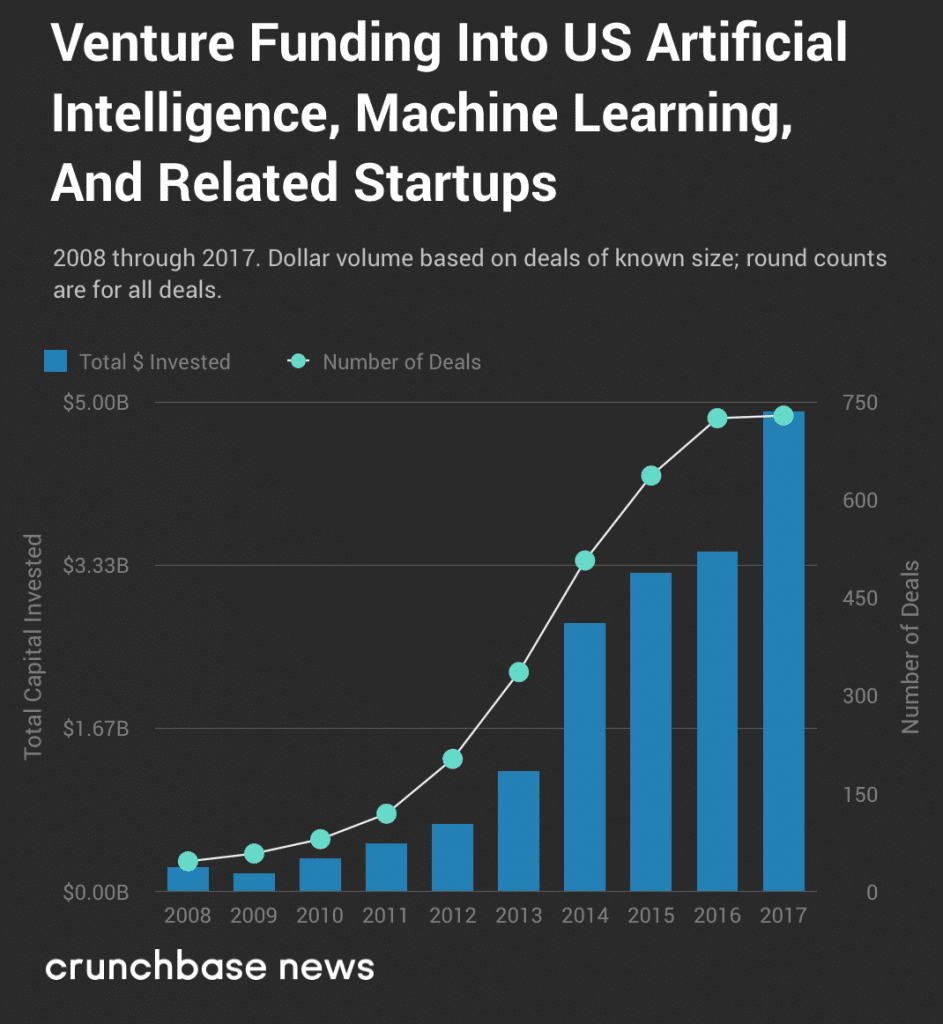

Another that’s riding high in investor awareness? Artificial intelligence, of course.

AI has seen a precipitous influx of funding over the past decade, best illustrated in the chart at left, courtesy of Crunchbase. Their analysis? That VC investment in AI rose to nearly $5 billion in 2017, with almost 750 deals made.

Another example that might not be so top-of-mind? Real estate technology. In 2012, U.S. venture capital investment in real estate tech firms stood at only $44.7 million, according to Pitchbook, which tracks equity markets. In 2017, that number surged to a staggering $5.7 billion, or 127 times as much.

One more? Robotics, where there was a 670% increase in funding of robotics startups in just one year, from 2016 ($1.9 billion) to 2017 ($15 billion).

Investors are turning their eyes to legal tech

The LawFuel article and this column by Above The Law’s Robert Ambrogi are both tracking the increase in funding aimed at legal technology startups. At the current pace, investment will exceed $1 billion in 2018, which will refute much of the skepticism about legal tech investment being voiced by some analysts as recently as Q4 2017.

As Ambrogi points out:

Of course, there is an obvious pattern to these investments. All the companies are focused on the use of AI to streamline legal work and deliver better results. And all of the companies are targeting the big firm/big company sector.

Is there a growing legal technology bubble?

The consequences of all that funding? It helps support digital transformation of legal departments and Legal Operations, of course, by delivering a greater range of options for CIOs, CLOs, and other decision-makers to choose from. That’s a mixed bag, naturally. Which of these providers will survive the inevitable shakeout – and which ones won’t, leaving their customers holding another kind of bag for obsolete or unsupported technology?

In legal tech, as in other sectors, there are startups springing up at a furious pace, both driven by previous funding and hoping to take advantage of investor interest. One study found there were 3,465 companies with credible claims to be developing or marketing AI-related products worldwide.

There’s always the worry that a spate of investment like this can drive an unsustainable bubble such as the one Forbes predicts in AI. Of those thousands of AI startups, a tiny fraction will survive any shakeout. And there’s always a shakeout bound to come.

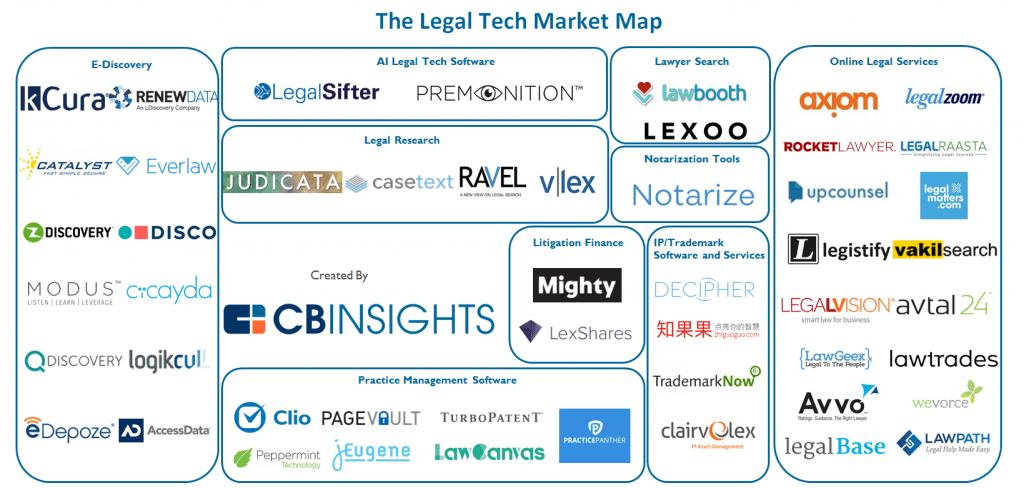

The market map of legal technology providers at right just touches the surface, though it shows some of the segments in legal tech where competitors are trying to stake their claims. According to the Angel List, as of this writing there were no less than 2,002 legal technology startups trying to plant their stake in the marketplace. Though it’s notable that some on the list are already defunct.

The market map of legal technology providers at right just touches the surface, though it shows some of the segments in legal tech where competitors are trying to stake their claims. According to the Angel List, as of this writing there were no less than 2,002 legal technology startups trying to plant their stake in the marketplace. Though it’s notable that some on the list are already defunct.

The churn among legal technology startups makes it impossible to be predicting success or failure for individual companies. But you can put money on the fact most of them will be a write-off for investors in a few years.

Planning for beyond the tipping point

The “tipping point” where availability of technology meets a driving need of legal professionals to embrace legal tech is close to becoming a reality. Everett Rogers’ model of the diffusion of innovations will take repeat itself one more time. Just as it has, over the decades, for technologies ranging from color television to smartphone apps.

To take advantage, a legal technology startup has to go the last mile and encourage adoption by legal professionals. Whether they’re law firms or in-house legal departments and Legal Operations teams. As in other tech sectors, adoption is often the toughest nut to crack. In legal technology? It may prove even harder.

The legal industry has an inherent conservatism and leeriness of risk. That should, with good reason, translate into judiciousness on their part when it comes to evaluating and adopting fresh technologies.

There’s a huge amount at stake for in-house legal teams and outside counsel alike, especially if technologies touch outcome-critical areas like discovery or matter management. Making the wrong tech adoption decision can have reverberations for years.

As our own Brian McGovern, former Legal Chief Data Officer, pointed out in a recent webinar, it’s critically important for anyone considering legal tech adoption to:

- Have an understanding of their level of technological maturity.

- To understand where legal tech can show a real and immediate impact and ROI.

- Draw up a roadmap for legal technology adoption that gives them a sound, secure path forward.

By taking a considered approach like this, only the most worthy, most proven legal technology providers will make the cut. That’s as it should be. For all the buzz about capital flooding the legal tech sector, there’s only one investment a legal department or law firm should concern itself with: The money they’re investing in a legal technology product, and the likelihood it’ll pay immediate and long-term dividends.