Escalating Outside Counsel Spend

Hundreds of millions in litigation costs flow through outside firms with limited visibility into efficiency or billing accuracy.

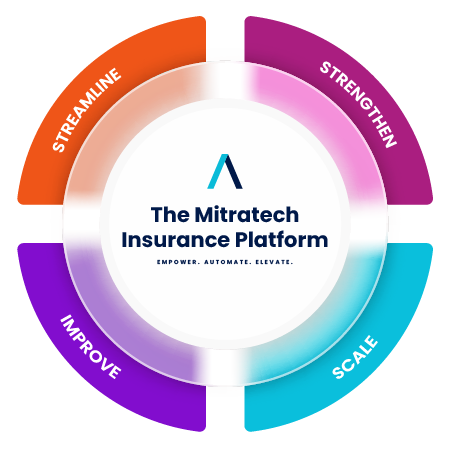

Mitratech powers every side of insurance operations — helping you manage cases faster, reduce spend, and leverage data for smarter decision-making.

At the core of every insurer’s business model is a simple equation: price risk, invest premiums wisely, and manage claims litigation as efficiently as possible.

That’s why insurers — from property & casualty to life, health, and commercial lines — turn to Mitratech. We empower corporate legal teams, staff counsel, and claims litigation departments with the tools to cut costs, strengthen outcomes, and scale operations without slowing down claims or customer service.

With Mitratech, you can reduce outside counsel spend, accelerate staff counsel case management, and bring data-driven precision to every decision.

Hundreds of millions in litigation costs flow through outside firms with limited visibility into efficiency or billing accuracy.

Disconnected matter management, eBilling, and claims systems make it impossible to see exposures, track outcomes, or control spend.

CLOs and claims executives are tasked with reducing leakage and delivering defensible, data-backed cost savings year over year.

Large-ticket litigation demands predictive analytics and rigorous oversight to avoid runaway settlements.

Thousands of slip-and-fall, auto, and property cases overwhelm staff counsel, requiring law-firm-grade case management at scale.

Critical deadlines, filings, and hearings slip through the cracks without automation, driving risk and wasted time.

Staff attorneys and paralegals lose hours creating routine pleadings, NDAs, and discovery responses instead of focusing on case strategy.

With constant staff changes, insurers struggle to standardize processes and onboard new attorneys quickly and consistently.

From corporate legal to staff counsel to claims litigation, Mitratech gives insurers the tools to manage spend, automate casework, and harness analytics — all while keeping customer service and claims delivery on track.

Programe su demostraciónInsurance leaders know that litigation efficiency and cost control are core to profitability. That’s why 7 of the top 10 P&C insurers trust Mitratech: our solutions empower corporate legal, staff counsel, and claims teams to unify operations, reduce spend, and drive stronger outcomes — while staying ready for regulators and responsive to policyholders.

Unify matter management, eBilling, legal hold, and document management in a single platform. Give CLOs and corporate legal teams the visibility they need to control outside counsel spend, enforce billing guidelines, and protect defensibility.

Explore all Legal Solutions

Gain enterprise visibility into every dollar spent, enforce billing guidelines, and build defensible audit trails.

Explore Spend Management SolutionsAutomate compliant background checks for producers, underwriters, and claims staff, while surfacing early warnings for fraud, turnover, or compliance gaps through real-time workforce analytics.

Explore Insurance Background Screening SolutionsTransform static risk assessments into dynamic, real-time profiles for vendors, systems, and processes — and align your controls with insurance industry cybersecurity and solvency standards.

Explore Comprehensive Insurance Risk Management

Centralize insurance policy distribution and compliance training, track attestations, and monitor professional certifications like CPCU, AINS, and state adjuster licenses — all in one audit-ready platform.

Explore Policy Management SolutionsPrepare for data breaches, system outages, or natural disasters with structured continuity plans and real-time communication tools for agents, claims teams, and policyholder support.

Explore Continuity Planning SolutionsTrack claims litigation, regulatory actions, and internal investigations while managing outside counsel spend, billing guidelines, and invoice audits for improved cost control.

Explore Matter Management + eBillingAutomatically preserve emails, claims files, and system data tied to litigation, regulatory inquiries, or internal investigations — across departments and custodians.

Explore Legal Hold SolutionsGenerate producer agreements, NDAs, service contracts, and reinsurance documents from approved templates — ensuring accuracy, compliance, and faster turnaround.

Explore Mitratech Automatización de DocumentosStreamline onboarding, license verification, and policy attestation for producers — with built-in reminders and full audit trails.

Explore Employee Onboarding SoftwareAccelerate policy approvals, claims escalations, and compliance reviews — without adding IT burden or relying on manual routing.

Explore Workflow AutomationCentralize due diligence and continuously monitor MGAs, TPAs, and partners for regulatory alignment.

Explore las soluciones de TPRM

Built to power litigation efficiency, spend control, and operational excellence across insurers, brokers, and TPAs — giving leaders the tools to price risk, manage claims, and protect profitability.

For CLOs and Claims leaders: Centralize matter management and eBilling, automate invoice review, and apply Managed Bill Review to stop leakage and ensure every dollar of legal spend delivers measurable value.

For CLOs and Claims executives: Leverage predictive analytics to benchmark firm performance, forecast outcomes, and allocate resources with actuarial precision — bringing the insurer’s data-driven culture into legal operations.

For Heads of Staff Counsel: Run your captive law firms with law-firm discipline. Automate docketing, calendaring, and document generation so attorneys can handle high-volume, low-complexity cases efficiently and consistently — even amid staff turnover.

For enterprise legal teams: Connect corporate legal, claims, and staff counsel on a single platform. Gain a consolidated view into matters, spend, and exposures to drive cross-functional collaboration and support defensible decision-making.

Our eBilling platform and Managed Bill Review services give insurers real-time oversight into legal invoices, ensuring accuracy, consistency with billing guidelines, and benchmarking against peer performance. This helps carriers cut leakage and deliver measurable savings on litigation costs.

Unlike generic legal tech, our solutions are built for the scale of insurance defense. CaseCloud and HotDocs let staff counsel manage thousands of low-complexity cases efficiently — with automated docketing, calendaring, and document generation that standardize processes and reduce training burdens.

Yes — CLOs at insurers face many of the same challenges as their peers in other sectors: managing matters, overseeing spend, and ensuring defensibility. With Mitratech, they gain a consolidated view across corporate, claims, and staff counsel operations, eliminating silos and surfacing risk faster.

For Chief Claims Officers and litigation leaders, Mitratech provides predictive analytics and spend control to manage high-value, complex claims. By combining invoice review, outcome benchmarking, and resource allocation tools, we help insurers strengthen litigation outcomes and protect profitability.

Absolutely. While P&C carriers face the most litigation volume, life and health insurers also rely on Mitratech for matter management, staff counsel oversight, and spend analytics. Our solutions scale across lines of business, jurisdictions, and organizational structures.

Schedule a demo to see how you can reduce outside counsel costs, scale staff counsel, and strengthen outcomes across your entire legal ecosystem.

See the Difference

©2025 Mitratech, Inc. Todos los derechos reservados.

©2025 Mitratech, Inc. Todos los derechos reservados.