Agent & Broker Onboarding Delays

Managing appointments, licensing, background checks, and certifications across states and entities can drag down productivity and violate SLAs.

Get fully defensible with insurance compliance software that knows the rules — and the risks

From property & casualty to life, health, and commercial insurers, Mitratech helps carriers, brokers, and TPAs operate with total compliance confidence — without slowing down claims or customer service.

Whether you’re navigating a web of state-level regulations, overseeing complex litigation portfolios, or onboarding new agents across jurisdictions, Mitratech empowers legal, compliance, HR, and risk teams to move fast, stay aligned, and mitigate liability.

Managing appointments, licensing, background checks, and certifications across states and entities can drag down productivity and violate SLAs.

Paper-based reviews of internal claims handling standards or anti-fraud protocols leave gaps and audit risk.

Inconsistent or inaccessible SOPs, policies, and disclosures increase training burdens and raise exposure during disputes.

Disparate systems mean compliance teams are stuck chasing updates instead of building defensible audit trails.

From HIPAA and GLBA to state-specific privacy, licensure, and producer laws, complexity multiplies with every new region and business line.

Missed deadlines, incomplete matter documentation, or inconsistent legal hold processes can tank defensibility.

TPAs, subrogation vendors, field investigators, and tech vendors can introduce unchecked regulatory or reputational risk.

Employee misconduct, retaliation claims, or unreported concerns can quietly erode compliance posture until it’s too late.

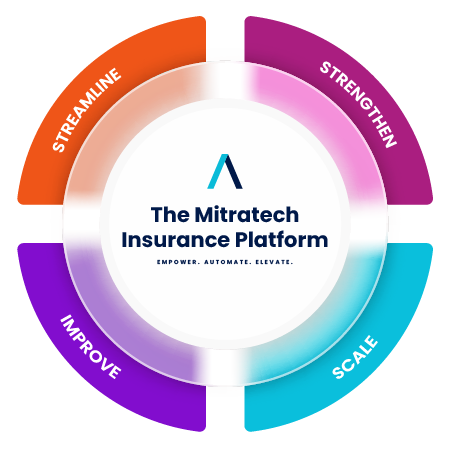

Mitratech supports end-to-end legal, HR, compliance, and risk oversight for insurers who must move fast, defend hard, and prove it all.

Planen Sie Ihre DemoKeep your workforce, partners, and policyholders protected — with user-friendly compliance solutions built for the complex and highly regulated insurance industry.

Conduct compliant background checks for producers, underwriters, and claims staff, while surfacing early warnings for fraud, turnover, or compliance gaps.

Strengthen Hiring ConfidenceTransform static risk assessments into dynamic, real-time profiles for vendors, systems, and processes — and align your controls with insurance industry cybersecurity and solvency standards.

Discover Dynamic Risk Management

Centralize insurance policy distribution and compliance training, track attestations, and monitor professional certifications like CPCU, AINS, and state adjuster licenses — all in one audit-ready platform.

Simplify Policy ComplianceVet and continuously monitor vendors, MGAs, TPAs, and service providers handling sensitive customer or claims data — with automated compliance mapping to NAIC model laws, HIPAA, GLBA, and state insurance regulations.

Manage Vendor Risk with ConfidencePrepare for data breaches, system outages, or natural disasters with structured continuity plans and real-time communication tools for agents, claims teams, and policyholder support.

Build Business ResilienceTrack claims litigation, regulatory actions, and internal investigations while managing outside counsel spend, billing guidelines, and invoice audits for improved cost control.

Streamline Matter ManagementAutomatically preserve emails, claims files, and system data tied to litigation, regulatory inquiries, or internal investigations — across departments and custodians.

Protect Data with ConfidenceGenerate producer agreements, NDAs, service contracts, and reinsurance documents from approved templates — ensuring accuracy, compliance, and faster turnaround.

Automate Documents with EaseStreamline onboarding, license verification, and policy attestation for producers — with built-in reminders and full audit trails.

Simplify Employee OnboardingAccelerate policy approvals, claims escalations, and compliance reviews — without adding IT burden or relying on manual routing.

Unlock Smarter Workflows

Built to power compliance efforts across insurers, brokers, and TPAs — trusted by policyholders, and ready for what’s next.

From new agents to remote claims adjusters, Mitratech simplifies onboarding, streamline license verification, and continuing education tracking — across multi-state insurance networks.

Built with insurance staffing constraints in mind. Less burden, more control — all without sacrificing audit readiness.

Automate vendor due diligence, monitor data privacy exposure, and track third-party compliance with tools designed for regulatory alignment across NAIC, HIPAA, and state insurance laws.

Standardize claims investigations, workforce incident reporting, and policy attestations — without relying on disconnected tools or manual routing.

It’s a unified solution that helps insurers manage regulatory, legal, and workforce obligations — from claims and legal holds to policy rollouts and vendor risk — without the chaos of spreadsheets or siloed systems.

Yes. Mitratech is designed to handle jurisdictional complexity and regulatory nuance, with customizable workflows and centralized reporting.

With real-time policy tracking, defensible documentation, and built-in matter management, teams can respond quickly and confidently to external or internal scrutiny.

Absolutely. Track completion of required trainings, distribute updated ethics policies, and maintain secure reporting channels for incident intake.

Yes. Legal operations can manage matters, outside counsel, eBilling, contracts, and third-party oversight — all in one place.

From centralized oversight to local execution, Mitratech gives insurance leaders the tools to align people, processes, and policies — without slowing down what matters most: customer service and claims delivery. Stop reacting after the fact. Start building defensible, scalable compliance from the inside out.

Demo anfordern

©2025 Mitratech, Inc. All rights reserved.

©2025 Mitratech, Inc. All rights reserved.