What is CECL (Current Expected Credit Loss)?

CECL, or Current Expected Credit Loss, is a new accounting model the Financial Accounting Standards Board (FASB) has issued that changes how financial organizations account for credit losses. The FASB has changed how banks estimate their losses in the allowance for land and lease losses (ALLL) calculation. The introduction of the CECL compliance standard means that the probable loss threshold is removed and a lifetime credit loss allowance is required on day one of each exposure.

The Impact of CECL Implementation

Since the 2019 deadline, the CECL model has not only affected how banks calculate credit loss reserves, but also how organizations fundamentally manage their ALLL and organizational processes for both finance and enterprise risk management. For example, to ensure transparency and accuracy of results, auditors and regulators have scrutinized every detail of management frameworks for evidence of management control and data governance. Organizations have also had to consider the best way of delivering the challenging and complex CECL implementation project.

The scope of these changes have been substantial for some institutions, however, the level of their impact has depended on the complexity of the balance sheet. The changes required by CECL require a much deeper level of modeling, analysis and reporting than what has previously been required. And these changes are significant in terms of how banks will need to manage risk and financial data, build their analytic platforms and share information between departments.

It’s important to clarify that CECL doesn’t only apply to institutions in the financial industry. It’s for most companies that require Generally Accepted Accounting Principles (GAAP) compliance.

If you issue any of the following then you are required to be have CECL compliance:

- Trade receivables

- Loans

- Net investments

- Debt securities

How to Achieve CECL Compliance

CECL applies throughout the United States of America, having been issued by the Financial Accounting Standards Board. The CECL standard must be adhered to by all banking institutions operating within the country.

CECL regulations require financial institutions to adhere to a new set of rules and regulations. The effects of these changes have been far reaching for many organisations. Today’s financial institutions must take care to plan strengthened auditing capabilities, and ensure their own financial reporting compliance. Take a look at some of the ways in which organisations are maintaining their own CECL compliance below:

The Challenges of CECL Compliance

Current Expected Credit Loss reporting as an additional accounting requirement for US credit lending institutions is widely recognized as a significant technical, operational and compliance challenge for many institutions.

The combination of complex modelling, the use of large and changing volumes of portfolio and market data, and the need for consistent, accurate and auditable results means that institutions are now having to dedicate a significant amount of time and resources to CECL.

Key challenges for CECL will be:

- Data growth – to correctly account for the expected losses the new Current Expected Credit Loss model will bring substantial greater data requirements and changes to methodologies.

- Change in framework – one of the most significant changes is the move from an incurred loss to an expected credit loss accounting framework.

- Increased transparency – CECL will also require increased transparency in the application of assumptions and in the disclosures around the allowance estimate.

CECL Compliance for a Bad Debt Reserve Model: Examples

The comprehensive CECL model for bad debt reserve means that cashflow isn’t restricted, the assignment is correct and risk calculations are more accurate.

The CECL model achieves this by being:

- Forward looking: predictive approach using AI and machine learning.

- Automated: fully automated to combine company risk profiles and macroeconomic input.

- Predictive: integrated approach to company performance and global market for a comprehensive view of risk.

- Account-level risk assessment: evaluation starts at company level and incorporates all obligations inclusive of loss adjustment where relevant.

CECIL Risk Management and Governance Issues

The top five risk management and governance issues of implementing CECL are:

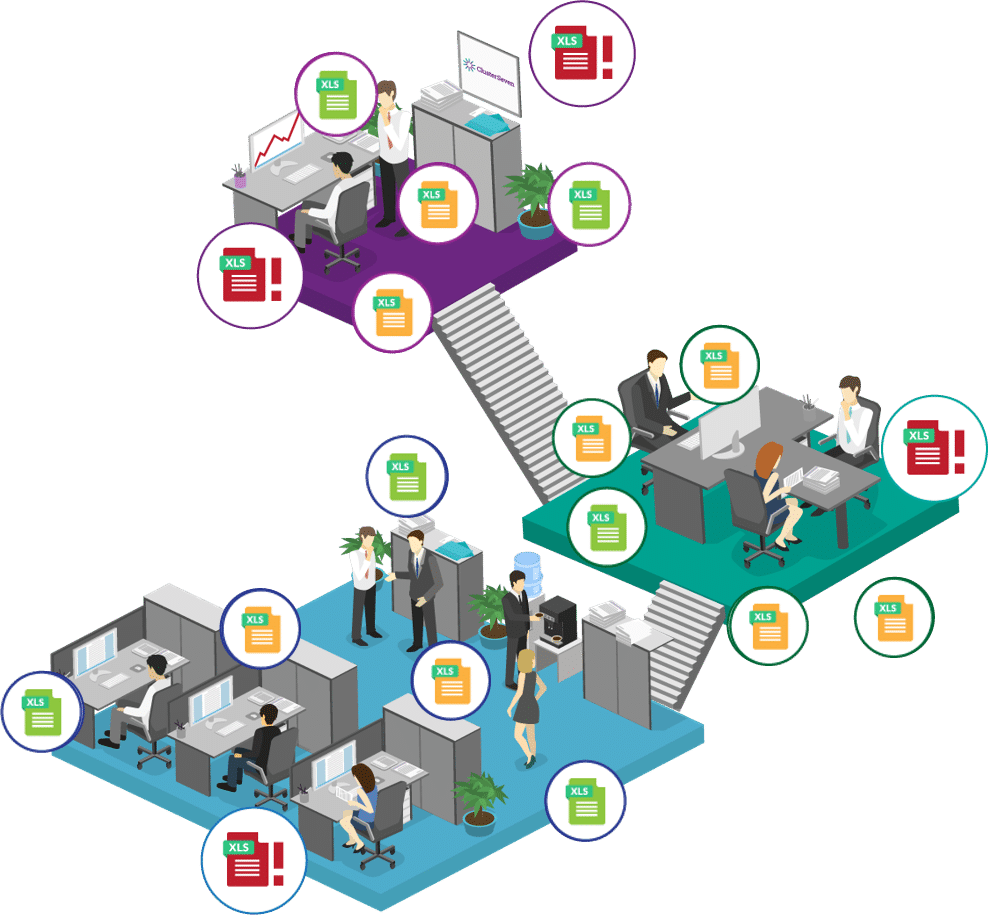

1. Extensive use of Uncontrolled Spreadsheets

Spreadsheets that are not controlled, tested or validated increase the likelihood of error, missing data and flaws that generate inaccurate results as well as creating audit issues.

2. Reliance on External Data Sources

Arrangements of external data sources now need to be regularly updated to keep models current. If this data is embedded in a CECL spreadsheet model, these data links have the potential for errors, giving risk to accuracy and transparency of data.

3. Widespread use of Integrated CECIL Spreadsheets, Macros and Formulas

Errors, omissions and changes to these can present risks than can materially impact the accuracy and auditability of the final results.

4. Business, Reputational and Regulatory Impact of Errors

The use of uncontrolled spreadsheets, with their inherent risks, can generate errors that could drive greater volatility, or even the need to restate earnings, potentially causing a range of business, reputational and regulatory headaches that institutions would want to avoid.

5. Audit and Regulatory Risk

Given the complexity of calculating CECL results, demonstrating this governance and control to external stakeholders, in a timely and cost effective fashion will be challenging. The cost of achieving this manually can be prohibitive.

How Prepare for CECL Compliance

1. Identify the CECL spreadsheets

These spreadsheets will be located in different departments, business units and even countries. Initially at least, as institutions start their CECL journey, there may be different versions, formats and definitions. This provides ample scope for the emergence of spreadsheet risk further down the implantation and reporting path.

2. Risk Assess those spreadsheets

Having a systematic risk assessment model for Current Expected Credit Loss allows people across the business to agree objectively which are the spreadsheets that require the closest scrutiny. This can form the basis of an effective CECL project implementation model, as well as serving to develop the risk management, audit and governance framework to which institutions now have to adhere.

It also ensures that the risk management focus is targeted at the right areas, rather than having the effort dissipated through assessing too many of the wrong spreadsheets.

3. Monitor and audit CECL spreadsheets

The final stage is to closely monitor your key CECL spreadsheets, to identify changes to them and their potential impact to the results and the wider business. It is important that changes to the spreadsheets – to formulas, data sources, individual worksheets and macros for example – can be easily identified, as they can have a material impact on the final CECL results, as well as the project implementation. Equally the absence of approved changes need to be easily identified, to ensure that the project remains on track.

How Spreadsheets Are Key to the CECL model

Given the current timescales and the challenge of developing the new models – coupled with the difficulties of making changes to complex enterprise systems – anecdotal evidence suggests that banking and lending institutions will have little option but to resort to the use of spreadsheet models.

To calculate CECL, these spreadsheets tend to have complex calculations, spread across a number of workbooks and dependent on data from external sources and applications. This spreadsheet modelling gives rise to significant spreadsheet risk to the CECL calculation process.

Due to the complexity of calculations, and the current widespread use of CECL Excel to deliver them, institutions are having to invest in spreadsheet management platforms to identify and control the relevant spreadsheets.

All CECL spreadsheets included in this framework are monitored to ensure transparency around the changes being made to each of the spreadsheet models to ensure no errors or omissions occur that, if undetected, would compromise the CECL data, models and final results.

This approach allows institutions to harness the power, flexibility, and familiarity of spreadsheets to adhere to CECL, while also ensuring they meet the governance and audit standards required. It helps reduce the implementation risks and timescales of their CECL project, while also reducing the scope for reputational, commercial and regulatory issues that may emerge from a complex set of CECL requirements.

Our focus? On your success.

Schedule a demo, or learn more about Mitratech’s products, services, and commitment.