Zweck und Bedeutung des Formulars I-9: Es handelt sich um ein zweiseitiges Dokument, das zur Überprüfung der Identität und der Beschäftigungsberechtigung von Personen dient, die für eine Beschäftigung in den Vereinigten Staaten eingestellt werden.

So, what is the I-9 form used for? Every employer is responsible for ensuring proper completion of a Form I-9 for all individuals hired for employment in the United States. Once completed, employers must retain these forms for a designated period of time for the purpose of future inspections sanctioned by the U.S. government.

Abschnitte des Formulars I-9

Wie sieht ein Formular I-9 aus? Das Formular I-9 besteht aus drei Abschnitten:

Section 1: Completed by the employee no later than the first day on the job (i.e. first day of work for pay); this includes work training. In Section 1, the employee must offer simple personal information such as his or her date of birth, address, and citizenship status.

Section 2: Completed by the employer no later than third business day after the employee begins work for pay*. In Section 2, the employer must verify the new hire’s identification by reviewing a USCIS-approved form of ID. Section 2 must be completed by the employer, or employer-approved representative, in person.

* Please note, if the employee will work three days or less, Section 2 must be completed no later than the first day of work for pay.

Section 3: Completed by the employer if the employee’s work authorization expires or if employee is rehired within 3 years of the date the Form I-9 was originally completed (a new Form I-9 may also be completed in place of completing Section).*

3). In Section 3, an employer will re-verify an employee’s work authorization to resume work for pay.

*Following the proper completion of Section 2, an Employer may choose to, or be required to, submit the completed Form I-9 to E-Verify.

Employers should note that Form I-9 may require updates not just for rehires, but also when a current employee’s employment authorization—or the documentation proving that authorization—expires. This applies specifically to employees who are not US citizens or noncitizen nationals. In these cases, Section 3 is used to document reverification, ensuring continued compliance with federal requirements. Remember, keeping the Form I-9 up to date is an ongoing responsibility, not a one-time task.

Acceptable Form I-9 Documents

To satisfy the I-9 requirements, employees must provide documentation that establishes both their identity and employment authorization. There are three lists of acceptable documents, and the rules are as follows:

- List A: Presents documents that establish both identity and employment authorization. Only one document from this list is required.

- OR

- List B and List C: If no document from List A is available, employees must present one document from List B (establishing identity) and one from List C (establishing employment authorization).

Examples of Acceptable Documents

List A (Identity and Employment Authorization)

- U.S. Reisepass oder U.S. Passkarte

- Permanent Resident Card or Alien Registration Receipt Card

- Employment Authorization Document Card

- Some foreign passports (with proper endorsements)

List B (Identity Only)

- Driver’s license or ID card issued by a U.S. state or outlying territory

- Voter registration card

- U.S. military card or draft record

- Native American tribal document

- Driver’s license issued by a Canadian government authority

Note: For individuals under 18 without the above documents, a school record, report card, clinic or hospital record, or day care/nursery school record may be presented.

List C (Employment Authorization Only)

- U.S. Social Security Card

- Original or certified copy of a birth certificate issued by a U.S. state, county, or municipal authority

- Certificate of Birth Abroad or Consular Report of Birth Abroad issued by the Department of State

- U.S. Citizen ID Card

- Identification Card for Use of Resident Citizen

Employers should carefully review these documents for authenticity and ensure that any combination provided satisfies the requirements before completing Section 2.

Acceptable Documentation for Form I-9: Lists A, B, and C

To complete Section 2 of the Form I-9, employees must present documentation showing both their identity and authorization to work in the U.S. The documents are categorized into three lists. Employees may provide:

- One document from List A (establishing both identity and employment authorization),

- or one document from List B (identity only) and one from List C (employment authorization only).

Below is an overview of each list:

List A: Documents That Establish Both Identity and Employment Authorization

Beispiele hierfür sind:

- U.S. Reisepass oder U.S. Passkarte

- Permanent Resident Card (“Green Card”) or Alien Registration Receipt Card (Form I-551)

- Employment Authorization Document with photo (Form I-766)

- Foreign passport with a temporary I-551 stamp or printed notation of permanent residence

- Foreign passport with a Form I-94 or I-94A indicating authorization to work

List B: Documents That Establish Identity Only

Items commonly accepted:

- State-issued driver’s license or ID card with a photograph or identifying information

- ID card issued by federal, state, or local government agencies or entities, provided it contains a photograph or identifying information such as name, date of birth, gender, height, eye color, and address

- Voter registration card

- U.S. military card or draft record

- Military dependent’s ID card

- Native American tribal document

- Driver’s license issued by a Canadian government authority

Note: For individuals under 18 who are unable to present the above, alternatives like a school record, report card, clinic or hospital record, or daycare record may be used.

List C: Documents That Establish Employment Authorization Only

Acceptable documents include:

- Social Security card issued by the Social Security Administration (not marked as “Not Valid for Employment”)

- Certification of Birth Abroad (Form FS-545) or Certificate of Report of Birth issued by the U.S. Department of State (Form DS-1350)

- Original or certified copy of a birth certificate issued by a state, county, municipal authority, or outlying territory of the United States, bearing an official seal

- U.S. Citizen ID Card (Form I-197)

- Identification Card for Use of Resident Citizen in the United States (Form I-179)

- Consular Report of Birth Abroad (Form FS-240)

Employers must review these documents in person and ensure they appear genuine and relate to the employee presenting them.

*Following the proper completion of Section 2, an Employer may choose to, or be required to, submit the completed Form I-9 to E-Verify (https://mitratech.com/products/tracker-i-9-compliance/e-verify-laws-by-state/).

Fünf technische Hilfsmittel für den Start Ihrer kleinen Einwanderungsfirma

Erfahren Sie, wie sie Ihnen helfen können, Ihr Einwanderungsunternehmen auf die Beine zu stellen.

Laden Sie den Leitfaden herunter!How to Fill Out Form I-9

Now that you know what the Form I-9 is and who handles each section, let’s walk through the steps of properly completing this critical document.

Completing Section 1 (Employee Information)

The first section is all on the employee—no pressure! New hires need to knock this out no later than their very first day of work (including any paid training sessions). Here’s what’s needed:

- Personal details: Legal name (and any other names used, such as maiden names), address, and date of birth.

- Citizenship or immigration status: The employee checks a box to indicate whether they’re a U.S. citizen, noncitizen national, lawful permanent resident, or otherwise authorized to work in the U.S.

- Additional documentation: If applicable, details like A-Number/USCIS number, Form I-94 admission number, or a foreign passport number and work authorization expiration date.

- Signature and date: The employee must sign and date Section 1 on the actual day it’s completed—no backdating allowed.

Pro tip: If your organization uses E-Verify, remind employees to include their Social Security number.

After the employee wraps up this section, the employer should double-check for any missing fields or signatures. If anything needs correction, the employee should update the form, initial, and date the change.

Completing Section 2 (Employer Review and Verification)

Within three business days of the employee’s start date, the employer steps in for Section 2. This is where you confirm the employee’s identity and right to work in the U.S. You’ll need to:

- Review original documents in person: Employees must bring acceptable documents (see the official ):

- Option 1: One document from List A (proves both identity and employment authorization)

- Option 2: One document from List B (proves identity) and one from List C (proves authorization)

- Never accept photocopies, unless it’s a certified copy of a birth certificate.

- Record details: Document type, issuing authority, document number, and expiration date (as applicable).

- Enter the start date: Fill in when the employee actually began work for pay.

- Complete and sign the certification: The employer or their authorized representative must sign and date Section 2, attesting that they’ve reviewed the documents in person (or, if permitted, via a DHS-authorized alternative procedure such as a live video review for E-Verify participants).

If the employee brings the wrong documentation, you can request alternates—but be careful to avoid any hint of discrimination.

Once these steps are done, you’re in the clear for Section 2. Proper completion here is key: mistakes can be costly if you ever face an audit.

Now, let’s take a trip back in time and explore where the Form I-9 got its start, and why it’s such an important part of every U.S. employer’s onboarding process.

Handling Unacceptable Documentation

What happens if an employee brings in documentation that doesn’t meet the requirements? Employers are obligated to ensure that documents presented are original, current (not expired), and found on the lists of acceptable I-9 documents. Photocopies won’t cut it—except for certified copies of birth certificates, which are the single exception to this rule.

If an employee provides a document that isn’t acceptable (perhaps it’s expired or simply isn’t on the approved list), the employer should politely inform the employee and ask for a different, valid document from the appropriate I-9 lists. The key is to offer the employee a fair chance to present alternative, qualifying documentation—without suggesting specific documents—that will fulfill the requirements. This helps ensure compliance and avoids the risk of discrimination based on citizenship or national origin.

Key Differences Between Form I-9 and Form W-9

You might have heard of both Form I-9 and Form W-9 in the hiring process, but they serve very different purposes:

- Form I-9 is all about employment eligibility. Every employer must use it to confirm the identity and authorization to work of every employee hired in the United States—regardless of the person’s citizenship. This form is required for anyone brought on as a standard (W-2) employee.

- Form W-9, by contrast, is tied to taxes. Instead of employment authorization, it gathers taxpayer identification details from independent contractors, freelancers, or vendors. Employers use the information from Form W-9 to generate a 1099 form, which reports payments made to those individuals for tax purposes.

In summary, if you’re onboarding a new employee, you’ll need Form I-9 to verify their right to work. If you’re engaging a contractor or an outside vendor, you’ll request a W-9 for tax reporting needs. Each form plays a crucial yet distinct role in the workplace compliance landscape.

The Spanish Form I-9: Who Can Use It?

If you’re wondering whether you can use the Spanish version of Form I-9 in the United States, here’s the scoop: U.S.-based employers are generally not permitted to use the Spanish-language I-9 for official completion—except in Puerto Rico. On the U.S. mainland, the Spanish form is provided solely as a reference or translation tool to assist Spanish-speaking employees in understanding or filling out the English version. For employers in Puerto Rico, however, using the Spanish version as the official form is both allowed and recognized by the U.S. Citizenship and Immigration Services (USCIS).

In summary:

- Employers outside Puerto Rico must complete and retain the official English version.

- The Spanish version can be used as a helpful guide during the process.

- Puerto Rico-based employers may use the Spanish form to satisfy federal requirements.

This distinction helps ensure all documentation complies with federal law—regardless of which language assists the employee during onboarding.

Is Form I-9 the Same as a Background Check?

It’s a common misconception, but the Form I-9 is not a background check. While employers frequently conduct background checks—looking into an applicant’s work experience, education, or potential criminal history—the I-9 serves a different, very specific purpose.

The Form I-9 is strictly part of the onboarding process, and it’s only concerned with verifying an employee’s identity and authorization to work in the U.S. No deep-dive into your personal history, no checking up on your references or running a criminal records search—just a focus on the documents that prove you’re eligible to work.

Employers complete the I-9 for every new hire, regardless of whether or not a traditional background check is conducted and regardless of the type of position.

Geschichte des Formulars I-9: Was ist die I-9 Dokumentation?

The I-9 came about as a result of the Immigration Reform and Control Act (IRCA) of 1986. This act was established to accomplish two things: prevent the employment of undocumented immigrants or others not authorized to work in the United States, and to prevent workplace discrimination based on citizenship or national origin.

In order to comply with federal law, U.S. based employers must verify the identity and employment authorization of each person they hire, complete and retain a Form I-9 for each employee, and refrain from discriminating against individuals on the basis of national origin or citizenship. I-9 compliance is mandatory for all employers and significant fines can be incurred in the event of an audit by Immigration and Customs Enforcement (ICE) or other federal bodies.

As of May 2019 there have been 13 versions of the Form I-9. The most recent form was revised in July of 2017 and took effect September 18, 2017. Many of these revisions either add/remove data fields, modify requirements for documentation needed in Section 2/Section 3, and/or often include rule changes that impact the Form I-9 process. For this reason, it’s imperative that employers use the most recently revised form.

Failure to utilize the most updated version of the Form I-9 can easily lead to severe penalties in the event of an audit. View a full history of previous versions of the Form I-9.

How can employers maintain compliance with I-9 verification?

Staying on top of I-9 verification may feel like spinning plates—timelines are strict, storage rules are specific, and one misstep could mean headaches down the line. To ensure compliance, employers should:

-

Complete each I-9 promptly:

Section 1 must be filled out by the employee no later than their first day of work, while Section 2 must be completed by the employer within three business days. set calendar reminders if needed—no one wants a late form tripping up their onboarding process.

-

Retain forms securely:

I-9s must be stored in a way that they’re easily accessible in the event of an inspection by Immigration and Customs Enforcement (ICE) or another federal agency. This could mean keeping them separate from general employee files and backing up electronic copies if you go digital.

-

Regularly audit your records:

Periodic internal checks help identify expired documentation, missing signatures, or outdated forms. Catching mistakes before the auditor does is always preferable!

-

Consider electronic solutions:

Digital I-9 verification platforms, such as E-Verify-compatible tools, simplify storage, automate reminders for re-verification, and centralize documentation—streamlining your compliance efforts and reducing paperwork chaos.

By embracing these best practices, employers can more easily steer clear of compliance pitfalls, free up time for other HR matters, and maintain peace of mind come audit season.

Warum sollten sich Arbeitgeber mit dem Formular I-9 befassen?

Just as any federal document, the Form I-9 is not to be taken lightly. In fact, the Form I-9 is more than just a form that must be completed upon hiring a new employee – it is a covenant between employer, employee, and the U.S. government which attests that the employer is in fact hiring an employee who stands in compliance with the federal and state guidelines for legal employment at the time of the completion of the I-9.

Employers are required by law to complete Form I-9 for all W-2 employees within three days of the employee’s first date of employment. Failure to fill out Form I-9 may result in civil or criminal penalties. This legal obligation is not just a bureaucratic formality—failure to comply can have serious consequences.

Ein - versehentlicher oder vorsätzlicher - Verstoß gegen diese Vereinbarung kann für den Arbeitgeber und den Arbeitnehmer verschiedene Probleme mit sich bringen, unter anderem:

- Warnhinweis

- Geldbußen

- Strafverfolgung

- Razzien am Arbeitsplatz

- Office of Chief Administrative Hearing Officer (OCAHO) hearings

- Gerichtliche Vergleiche

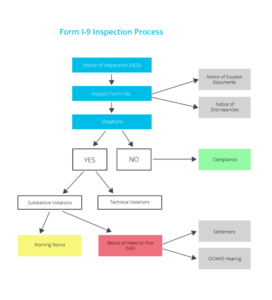

The varying degrees of violations and penalties noted above are administered by the Immigration and Customs Enforcement Agency (ICE) after a Notice of Inspection (NOI).

NOIs und das Formular I-9

An ICE audit is initiated when an ICE agent arrives at an organization to serve a Notice of Inspection (NOI). The person receiving service of the NOI will need to sign a document acknowledging receipt. We’ve supported companies through dozens of I-9 audits and we suggest that you take NOI’s very seriously. If you receive an audit notice, it is imperative that you act immediately and acquire the guidance of a compliance professional that can guide you through the ICE inspection process.

Nachfolgend finden Sie einen groben Überblick über den Ablauf der I-9-Inspektion und darüber, was Sie erwarten können, wenn Sie ein NOI erhalten.

Once an NOI is received, the employer has 72 hours to produce the requested I-9s and any other accompanying documentation dictated by the subpoena that accompanies the NOI. Additional documentation required by ICE typically includes payroll records and tax filings, lists of active and inactive employees, business information (EIN’s, articles of incorporation, business licenses, etc.), E-Verify information (case numbers for I-9s), and other employment documentation. Although the employer typically has 72 hours to respond to the NOI, extensions may be granted with good reason.

As a next step, ICE agents/auditors conduct an inspection of an employer’s I-9s for compliance. If no corrections are needed and the employer is found to be compliant, the ICE agent will inform the organization of their status and close the case. However, if technical or substantive violations are found, an employer is typically granted ten business days to correct the non-compliant I-9s. Time extensions are rarely provided and employers may receive a Notice of Intent to Fine (NIF) for all substantive and uncorrected technical violations found on the I-9s.

Employers who have been found to knowingly hire or continue to employ unauthorized workers will be required to cease unlawful activity, may incur an NIF, and may also see criminal persecution. Fines for knowingly hiring employees who are not authorized to work range from $375 to $16,000 per violation, with repeat offenders receiving penalties weighted toward the higher end of the spectrum. Penalties for substantive violations range from $216 to $2,156 per violation.

An important thing to note here is that ICE assesses violations per error or omission, not per Form I-9. A single I-9 can easily contain multiple violations, each of which can result in a fine.

Die wichtigsten Faktoren, die das ICE bei der Festlegung der Strafhöhe berücksichtigt, sind:

- Größe des Unternehmens

- Nachweis des guten Willens zur Einhaltung der Vorschriften

- Schwere des Verstoßes

- ob der Verstoß nicht autorisierte Arbeiter betraf

- Vorgeschichte von Verstößen

If a NIF is served, ICE will provide charging documents that specify all violations committed by the employer. The employer then has the option to negotiate a settlement with ICE or request a hearing before the Office of the Chief Administrative Hearing Officer (OCAHO) within 30 days of the NIF.

Nach Angaben des ICE wird dem Fall ein Verwaltungsrichter zugewiesen. Viele OCAHO-Fälle erreichen jedoch nicht die Anhörungsphase, weil die Parteien einen Vergleich schließen, die Parteien sich der Zustimmung des ALJ unterwerfen oder der ALJ eine Entscheidung in der Sache trifft, indem er vor der Anhörung dispositive Entscheidungen trifft.

Example: In September 2017, Asplundh Tree Expert Co was sentenced to pay a whopping $95 million in forfeitures and civil claims for knowingly employing undocumented immigrants. Although this is an extreme example, this case shows that violators who manipulate hiring laws and support the acceptance of fraudulent documentation when hiring new employees will be caught and penalized accordingly. Read more about this case.

The I-9 is ever-changing and continues to be updated every few years. At a minimum, it is imperative to use the most recent Form I-9 mandated by USCIS and ensure that all sections of the I-9 are completed in a compliant and timely manner. Mitratech offers the only I-9 compliance solution to maintain a perfect 20+ year track record of zero client fines in federal and ICE audits.

Die wichtigsten I-9 Missverständnisse

1) Die Teilnahme an E-Verify ersetzt das Formular I-9. Wir brauchen nicht beides zu tun.

This is false. The E-Verify program does not replace the Form I-9 and participating in E-Verify does not remove an employer’s obligations to comply with the I-9 process. The I-9 is mandatory to all employers, while E-Verify is required for an employer if they are a Federal Contractor or employ people in certain states where state law mandates the use of E-Verify.

Weitere Unterschiede zwischen dem Formular I-9 und E-Verify:

- Das Formular I-9 wird zur Überprüfung der Identität und der Beschäftigungsberechtigung verwendet, während E-Verify ein internetbasiertes System ist, das zur Feststellung der Beschäftigungsberechtigung eingesetzt wird.

- SSN documentation is not required for the I-9, while E-Verify does require a SSN.

- Ein I-9 muss zur erneuten Überprüfung einer abgelaufenen Beschäftigungsgenehmigung verwendet werden, während E-Verify nicht zur erneuten Überprüfung einer abgelaufenen Beschäftigungsgenehmigung verwendet werden darf.

- Das Formular I-9 muss sowohl vom Arbeitnehmer als auch vom Arbeitgeber ausgefüllt werden, während E-Verify ausschließlich vom Arbeitgeber oder einem vom Arbeitgeber bevollmächtigten Vertreter auszufüllen ist.

2) Wenn die I-9-Formulare in einem elektronischen System gespeichert sind, bedeutet dies, dass die I-9-Formulare vollständig konform sind.

This is false. Whether you’re on an electronic system that is home-grown, provided as a standalone system, bundled into an onboarding package, or tied into an HRIS/ATS/HCM, it must still adhere and comply in accordance to the record-keeping standards that ICE requires. Ultimately, the responsibility for completing I-9s lies in the hands of the employer. Even with an electronic system, errors can easily loom in the system until exposed during an ICE inspection.

When evaluating I-9 vendors, it is critical to ask the right questions. Here are some suggested considerations as you evaluate electronic platforms:

- Does the I-9 vendor have a dedicated team of attorneys who inform product improvements? This is crucial.

- Who is the existing client base? Is the I-9 vendor able to produce references in the same industry and of the same employee size as your own company?

- How long has the vendor been in the market and how many of their clients have been audited? How many have received fines?

- Does the vendor allow for third parties to audit their system?

- Does the vendor document audit trails? This is required by ICE.

Da die Einhaltung der Vorschriften der zentrale Aspekt des Formulars I-9 ist, sollte jeder Anbieter in der Lage sein, eine Geschichte der erfolgreichen Unterstützung von Kunden durch mehrere Bundesaudits vorzuweisen. Wie das ICE-Audit bei Abercrombie & Fitch gezeigt hat, ist ein elektronisches I-9-System keine Garantie dafür, dass das ICE einem Unternehmen in Bezug auf die Einhaltung der Vorschriften zwei Daumen hoch gibt.

3) I-9s für einen entfernten Mitarbeiter: Die Überprüfung von Abschnitt 2 des Formulars I-9 kann per Videochat oder durch Übersendung von Unterlagen zu Abschnitt 2 per E-Mail erfolgen.

This is false. Verifying Section 2 of the I-9 must be done in person by either the employer or its representative. It is not compliant to hire an employee without having the employer or employer representative view the documentation in the physical presence of the employee.

If using an advanced electronic I-9 management platform, employers may opt to use remote Section 2 features, such as Tracker’s I-9 Remote, to compliantly complete document verification anywhere in the United States.

But what does “in-person” verification actually involve?

Section 2 is completed by the employer (or an authorized representative) and requires reviewing the employee’s identity and employment authorization documents. Before starting Section 2, employers should always check Section 1 for accuracy—if there are any errors or missing information, the employee must make corrections, then initial and date those changes before resubmitting.

For verification, employees may present either:

- One document from List A (which shows both identity and employment authorization), or

- One document from List B (proof of identity) and one from List C (proof of employment authorization).

The employer (or authorized representative) must then physically examine each document, in the presence of the employee, to determine if it appears genuine and original. Documentation must be original, unexpired, and from the lists of acceptable documents—photocopies are not permitted (with the exception of certified copies of birth certificates).

A note for employers using E-Verify: As of August 2023, DHS has permitted certain employers enrolled in E-Verify to use an alternative remote procedure, allowing document examination over a live video call. If you qualify and choose this option, make sure you follow all DHS requirements and document the process accordingly.

After verifying the documents, the employer records the document title, issuing authority, document number, and expiration date (if any) on the I-9 form, and checks the appropriate boxes regarding participation in E-Verify or remote examination.

If an employee supplies unacceptable documentation, the employer should request alternative documents from the lists of acceptable documents. Remember, compliance hinges on the proper completion and verification of Section 2—cutting corners here can lead to costly mistakes.

4) I-9s are no longer needed after an employee has quit or has been terminated.

This is false. It’s absolutely critical that an employer retains I-9s for both current and ex-employees. The 3-year rule applies: I-9s must be kept three years from the date of hire or one year from the date of termination, whichever is later.

Häufige Fehler im Formular I-9:

- Timeline of completion is ignored. USCIS maintains strict timeline requires that cannot be overlooked.

- Nichtausfüllen beider Seiten des Formulars I-9. Es gibt zwei Abschnitte, die ordnungsgemäß ausgefüllt werden müssen.

- Verwendung von White-Out. White-Out ist niemals erlaubt

Häufige Fehler von Arbeitnehmern:

- Failure to enter name, date of birth, or address.

- Versäumnis, den ersten Tag der Beschäftigung anzugeben.

- Fehlender Hinweis auf den Aufenthaltsstatus.

- Wenn der Arbeitnehmer "Lawful Permanent Resident" wählt, gibt er die USCIS-Nummer nicht an.

- Wenn das Formular I-9 mit Hilfe eines Übersetzers ausgefüllt wurde, versäumt es der Mitarbeiter, das Formular vom Übersetzer unterschreiben, mit seinem Namen versehen und datieren zu lassen.

Additional common mistakes include neglecting to complete all required fields in Section 1, such as omitting other legal last names used (like a maiden name), failing to check the appropriate box for citizenship or immigration status, or not providing an A-Number/USCIS Number, Form I-94 admission number, or foreign passport number and employment authorization expiration date when applicable. Employees must sign and date Section 1 on the actual date of completion—backdating is never acceptable. For employers using E-Verify, the employee must also provide their Social Security number as issued by the Social Security Administration. Once Section 1 is complete, the employee should present the form along with their identity documentation for review.

Häufige Fehler von Arbeitgebern:

- Versäumnis, die genehmigten Unterlagen in das Formular I-9 einzutragen.

- Nichtvorlage von Abschnitt 2 nach dem dritten Arbeitstag der ersten Beschäftigung.

Section 2 of the I-9 is the employer’s responsibility and centers on verifying the employee’s identity and employment authorization. Before diving into Section 2, employers should review Section 1 for accuracy—if there are errors or missing information, the employee must correct, initial, and date those changes before proceeding.

For verification, employees may present either:

- One document from List A (proving both identity and work authorization), or

- One document from List B (identity) and one from List C (employment authorization).

Employers (or their authorized representatives) must physically examine each document in the employee’s presence (unless using a DHS-authorized remote procedure, such as those introduced for E-Verify participants in August 2023). Documents must be original and unexpired—photocopies aren’t accepted, with the exception of certified copies of birth certificates. If an employee tries to provide unacceptable documentation, the employer should request alternatives from the official lists.

Once documents are accepted, employers need to:

- Enter the document title, issuing authority, document number (if any), and expiration date (if any).

- Record the employee’s start date.

- Complete any required employer information on the form.

- If a DHS-authorized remote procedure was used, note this in Section 2.

- Sign and date the form.

Skipping any of these steps, or failing to complete Section 2 accurately and on time, can quickly land an employer on an auditor’s “naughty list.”

- Fehlender Eintrag des Datums des ersten Beschäftigungsbeginns.

- Nichtangabe des Namens, der Anschrift oder der Bezeichnung des Unternehmens.

- Verwendung einer falschen/veralteten Version des Formulars I-9.

- Die Aufforderung an den Arbeitnehmer, spezifische Unterlagen zu Abschnitt 2 vorzulegen, ist eine Diskriminierung.

- Kopieren von Unterlagen - der Arbeitgeber darf nicht diskriminieren; wenn der Arbeitgeber Kopien aufbewahren möchte, muss er für alle Arbeitnehmer Kopien anfertigen.

- Der Arbeitgeber reicht Abschnitt 3 fälschlicherweise ein, nachdem die Arbeitsgenehmigung des Arbeitnehmers abgelaufen ist. Er muss den dokumentierten Nachweis mit dem angegebenen Ablaufdatum anfordern.

Aufbewahrung des Formulars I-9

Employers must be prepared to produce all Form I-9s in the event of an NOI. There are no specific legal restrictions to where and how an employer may choose to store their I-9s; however, it is recommended to avoid storing I-9 records in decentralized locations due to the difficulty of attaining those records in the event of a sudden audit. Common solutions include centralizing the process and uploading I-9s to a secure, cloud-based I-9 system.

Keep in mind that during an NOI, I-9 records requested can be those of employees who are currently employed, as well as terminated employees who fall within the termination retention period of USCIS’ rule: three (3) years from the date of hire or one (1) year from the date of termination, whichever is later.

The rule of thumb, therefore? Do not destroy an I-9 simply because an employee is no longer employed.

Andere hilfreiche Ressourcen?