How Can Risk Data Inform Strategic Decisions?

Today’s business environment demands greater intelligence. Boards and the C-suite must be provided with the necessary information to define strategic objectives and make critical decisions.

Unfortunately, risk managers and risk management teams often face the challenge of lacking a champion when it comes to strategic decisions. How can a risk manager prove that enterprise risk management (ERM) data has a guaranteed return on investment (ROI)?

Risk Managers can utilize data from compliance, incident, and risk tracking systems to support enterprise-wide strategic decision-making. The best way to gather that data is with an ERM solution for risk assessments, monitoring, issue remediation, and reporting.

Advocating for transformation

Risk can come from many unexpected directions, especially during these unprecedented times — including databases, websites, social media, video conferencing and unsecured access from remote settings. In-depth analysis and contextualization of this risk can point to a company’s past successes and also identify potential threats and opportunities.

Risk-driven intelligence can help in strategic planning and decision-making by:

- Encouraging data to be distributed across different organization levels and functions.

- Providing data uniformity about risky business decisions

- Diversifying CapEx investments.

- Improving capital allocation and freeing up capital for new market ventures.

- Launching new products and services.

- Calculating various outcomes and reducing the impact of risk events.

- Vetting targets for M&A transactions and evaluating your organization’s risk level within an acquisition.

Risk managers should take ERM data and frame it in language the board and C-suite can understand. How can you communicate the value of a data-driven risk culture to the executive level? An intuitive ERM-GRC solution can help risk managers advocate for a transformation in strategic decisions.

A solution for communicating the value of ERM

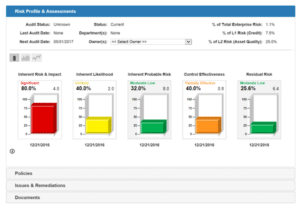

Enterprise risk assessment platforms are a powerful strategic planning tool. Risk managers gain the ability to assess the probability, impact, and controls necessary to mitigate risk across the enterprise.

You also gain an easy way to communicate the value of ERM on a numeric scale to leadership by using risk scorecards. With this data, you can prioritize risk mitigation for time, funds, and other resources. Investment decisions can be made that strengthen your company’s assets — all while protecting the organization from potential risks.

You also gain an easy way to communicate the value of ERM on a numeric scale to leadership by using risk scorecards. With this data, you can prioritize risk mitigation for time, funds, and other resources. Investment decisions can be made that strengthen your company’s assets — all while protecting the organization from potential risks.

The right ERM solution will provide critical data with visibility to help you transform actions into financial terms. This valuable insight can lead to more informed choices leading to new profitability and growth.

A risk-based approach can provide a systematic way to recognize and manage risks and make better strategic decisions. Expand your ERM frame of mind to all aspects of an enterprise, and you’ll wind up helping your organization to achieve optimized strategic decision-making.

[bctt tweet=”Risk managers should take ERM data and frame it in language the board and C-suite can understand…risk scorecard visualizations can be key to this.” username=”MitratechLegal”]

Defend yourself against vendor and enterprise risk

Learn about our best-in-class VRM/ERM solutions.