M&A: what in-house counsel expect for 2024

[Contributors: This post was originally published by the AdvanceLaw Team on AdvanceLaw Digital.]

The AdvanceLaw team surveyed senior M&A leaders and GCs about recent M&A trends and expectations for 2024. Read on to find out more!

More international deals with new components

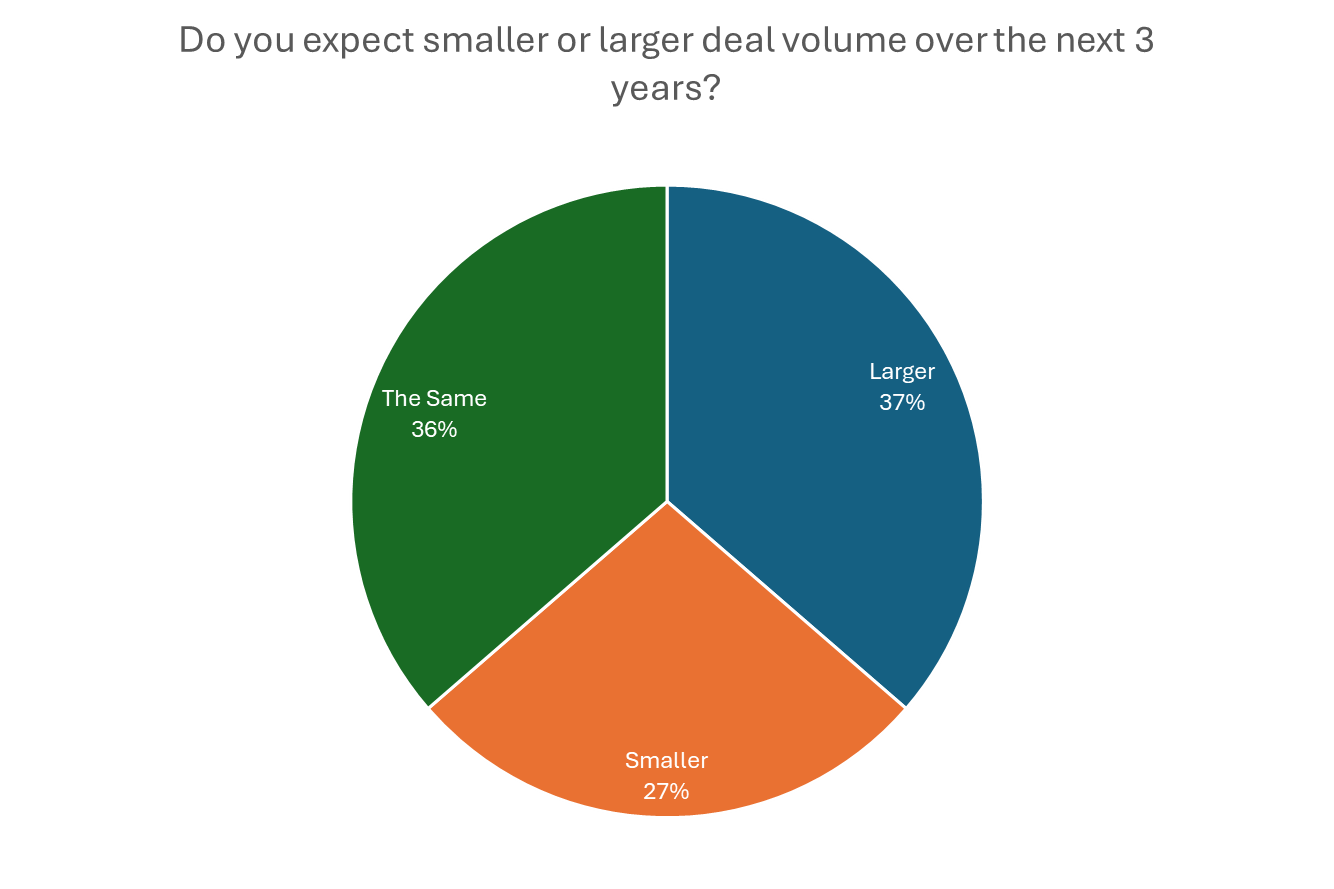

There’s no clear consensus on whether there will be more deals or less, but international markets will be active (and most in-house teams work on a mix of U.S. and international deals).

One GC shared that data and technology have created new commercial opportunities (such as IP) that may affect deal structures, pricing, and due diligence. Privacy and cybersecurity concerns remain top of the list – particularly when deals have an international element.

Mid-market firms are most commonly used for U.S.-only deals, with big multinational firms serving as the default for deals with an international component, even where the deal value is under $1B USD. AdvanceLaw has seen another, more cost-effective way of managing mid-sized deals: partnering a U.S.-based firm with an EMEA-based firm to collaborate on deals with international elements, offering GCs the best of both worlds (cost-effective advice and jurisdictional expertise).

Cost pressure remains high

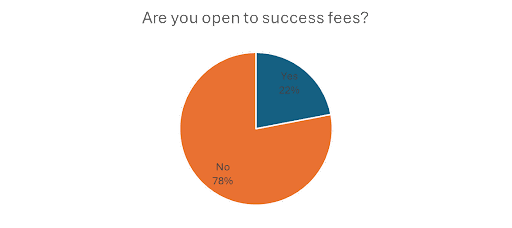

Cost continues to frustrate in-house teams when it comes to outside counsel, and the business continues to put pressure on keeping costs low. With rates steadily increasing (sometimes 10% yearly for elite firms, according to one GC), GCs want efficient, cost-effective counsel to handle deals under $1B. There’s a clear market opportunity here for firms who can be as efficient as possible. GCs continue to look to the firms to propose fixed fees for M&A work. We were surprised to hear that GCs aren’t using (and maybe aren’t interested) in broken deal fees and success fees – both of which offer incentives for getting a deal done creatively. Only about a third of GCs surveyed said they use broken deal fees, and about a fifth were open to paying success fees. If the legal team thinks it’s a viable deal (and is looking for creative ways to move forward) both broken deal fees and success fees should be reconsidered.

One firm or a competitive marketplace?

Often, teams have only a few firms that they consider for M&A work, and it’s most commonly one firm based on the business unit (reiterating the importance that in-house teams place on specific knowledge of the business).

In fact, even if in-house teams are not satisfied with a specific firm, they are quick to say that the firm knows their business and, therefore, is still better positioned to support, even if costs are high or the expertise isn’t there. This might be good news for underperforming incumbents, but GCs should set a higher bar for finding the right counsel (and consider whether they are overvaluing how much business knowledge plays into effective deal representation).

Overcoming the cost of switching firms

Luckily, there are many ways to make the cost of switching firms easier–here are a couple of best practices we’ve heard from leading M&A partners:

- Share a playbook with outside counsel. Prepare for conflicts, new geographies, or niche expertise by creating a deal playbook (or asking your corporate development team to share theirs). If not, share documents from the last similar deal – it’s a quick and easy way to show a firm your preferences.

- Suggest a new firm join you for a strategy session so that they can get to know your preferences for new deals before the deals are on the table. Both sides can talk through key issues, like your preferred form of purchase agreement, risk mitigation, use of reps and warranty insurance, key team members, and other specific-to-your company-nuances. You might have to spend an hour or two with the firm (and you’ll probably get a great meal out of it), but you won’t see this time on a bill.

- Ask how firms (current or prospective) are using generative AI. Most firms are actively exploring or using AI in various practice areas, and leaders of firm innovation have told us that M&A is high on the list of opportunities. GCs are unsure how this specifically plays into their deals, suggesting that firms should educate clients about the investments they are making in generative AI. (If you want to learn what cutting-edge GCs are telling their firms about the use of AI for their own work, check out our webinar on January 31st)

Law firm partners tell us that the biggest differences client-to-client aren’t about preferences in language or how deals are structured. Instead, it’s mostly about understanding the culture of the company and who plays what role. When you begin to work with outside counsel, be clear about your expectations: How do you want internal and external teams to work together? Who is leading this deal – legal or the business? How involved do you expect the CEO and/or GC to be? Experienced deal lawyers can adapt – and have seen it all before.

I have no idea where to start! Can you help?

Yes! Please contact the AdvanceLaw team to find out which firms are excelling for GCs at middle market deals, brainstorm ways to find more cost-effective counsel, or even learn more about our conversations with in-house teams.

Interested in Becoming an AdvanceLaw Member?

Join a network of General Counsel who are passionate about our model and want to engage our network of highly motivated outside counsel.

Please contact us to explore whether your legal team is a good fit.