What is the Form I-9?

The Form I-9’s purpose and meaning: It is a federally mandated, two-page document used for verifying the identity and employment authorization of individuals hired for employment within the United States.

So, what is the I-9 form used for? Every employer is responsible for ensuring proper completion of a Form I-9 for all individuals hired for employment in the United States. Once completed, employers must retain these forms for a designated period of time for the purpose of future inspections sanctioned by the U.S. government.

Sections of the Form I-9

What does an I-9 form look like? The Form I-9 has three sections:

Section 1: Completed by the employee no later than the first day on the job (i.e. first day of work for pay); this includes work training. In Section 1, the employee must offer simple personal information such as his or her date of birth, address, and citizenship status.

Section 2: Completed by the employer no later than third business day after the employee begins work for pay*. In Section 2, the employer must verify the new hire’s identification by reviewing a USCIS-approved form of ID. Section 2 must be completed by the employer, or employer-approved representative, in person.

* Please note, if the employee will work three days or less, Section 2 must be completed no later than the first day of work for pay.

Section 3: Completed by the employer if the employee’s work authorization expires or if employee is rehired within 3 years of the date the Form I-9 was originally completed (a new Form I-9 may also be completed in place of completing Section).*

3). In Section 3, an employer will re-verify an employee’s work authorization to resume work for pay.

*Following the proper completion of Section 2, an Employer may choose to, or be required to, submit the completed Form I-9 to E-Verify.

History of the Form I-9: What is I-9 Documentation?

The I-9 came about as a result of the Immigration Reform and Control Act (IRCA) of 1986. This act was established to accomplish two things: prevent the employment of undocumented immigrants or others not authorized to work in the United States, and to prevent workplace discrimination based on citizenship or national origin.

In order to comply with federal law, U.S. based employers must verify the identity and employment authorization of each person they hire, complete and retain a Form I-9 for each employee, and refrain from discriminating against individuals on the basis of national origin or citizenship. I-9 compliance is mandatory for all employers and significant fines can be incurred in the event of an audit by Immigration and Customs Enforcement (ICE) or other federal bodies.

As of May 2019 there have been 13 versions of the Form I-9. The most recent form was revised in July of 2017 and took effect September 18, 2017. Many of these revisions either add/remove data fields, modify requirements for documentation needed in Section 2/Section 3, and/or often include rule changes that impact the Form I-9 process. For this reason, it’s imperative that employers use the most recently revised form.

Failure to utilize the most updated version of the Form I-9 can easily lead to severe penalties in the event of an audit. View a full history of previous versions of the Form I-9.

Why should employers care about Form I-9?

Just as any federal document, the Form I-9 is not to be taken lightly. In fact, the Form I-9 is more than just a form that must be completed upon hiring a new employee – it is a covenant between employer, employee, and the U.S. government which attests that the employer is in fact hiring an employee who stands in compliance with the federal and state guidelines for legal employment at the time of the completion of the I-9.

Breach of this agreement – accidental or intentional – could spell various troubles to the employer and employee including but not limited to:

- Warning Notice

- Monetary Fines

- Criminal Prosecution

- Workplace Raids

- Office of Chief Administrative Hearing Officer (OCAHO) hearings

- Court Settlements

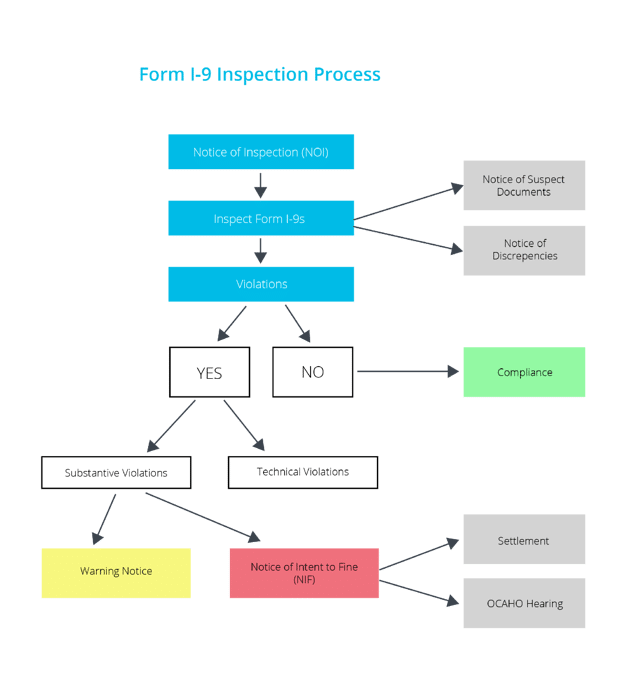

The varying degrees of violations and penalties noted above are administered by the Immigration and Customs Enforcement Agency (ICE) after a Notice of Inspection (NOI).

NOIs and the Form I-9

An ICE audit is initiated when an ICE agent arrives at an organization to serve a Notice of Inspection (NOI). The person receiving service of the NOI will need to sign a document acknowledging receipt. We’ve supported companies through dozens of I-9 audits and we suggest that you take NOI’s very seriously. If you receive an audit notice, it is imperative that you act immediately and acquire the guidance of a compliance professional that can guide you through the ICE inspection process.

Below is a rough overview of what the I-9 inspection process looks like from a high level and what you can expect in the event that you receive an NOI.

Once an NOI is received, the employer has 72 hours to produce the requested I-9s and any other accompanying documentation dictated by the subpoena that accompanies the NOI. Additional documentation required by ICE typically includes payroll records and tax filings, lists of active and inactive employees, business information (EIN’s, articles of incorporation, business licenses, etc.), E-Verify information (case numbers for I-9s), and other employment documentation. Although the employer typically has 72 hours to respond to the NOI, extensions may be granted with good reason.

As a next step, ICE agents/auditors conduct an inspection of an employer’s I-9s for compliance. If no corrections are needed and the employer is found to be compliant, the ICE agent will inform the organization of their status and close the case. However, if technical or substantive violations are found, an employer is typically granted ten business days to correct the non-compliant I-9s. Time extensions are rarely provided and employers may receive a Notice of Intent to Fine (NIF) for all substantive and uncorrected technical violations found on the I-9s.

Employers who have been found to knowingly hire or continue to employ unauthorized workers will be required to cease unlawful activity, may incur an NIF, and may also see criminal persecution. Fines for knowingly hiring employees who are not authorized to work range from $375 to $16,000 per violation, with repeat offenders receiving penalties weighted toward the higher end of the spectrum. Penalties for substantive violations range from $216 to $2,156 per violation.

An important thing to note here is that ICE assesses violations per error or omission, not per Form I-9. A single I-9 can easily contain multiple violations, each of which can result in a fine.

The greatest factors that ICE considers in its determination of penalty amount are:

- Size of the business

- Evidence of good faith effort to comply

- Seriousness of violation

- Whether the violation involved unauthorized workers

- History of previous violations

If a NIF is served, ICE will provide charging documents that specify all violations committed by the employer. The employer then has the option to negotiate a settlement with ICE or request a hearing before the Office of the Chief Administrative Hearing Officer (OCAHO) within 30 days of the NIF.

According to ICE, an Administrative Law Judge is assigned to the case, however; many OCAHO cases do not reach the hearing stage due to parties reaching a settlement, parties subjecting to the approval of the ALJ, or the ALJ reaches a decision on the merits through dispositive prehearing rulings.

Example: In September 2017, Asplundh Tree Expert Co was sentenced to pay a whopping $95 million in forfeitures and civil claims for knowingly employing undocumented immigrants. Although this is an extreme example, this case shows that violators who manipulate hiring laws and support the acceptance of fraudulent documentation when hiring new employees will be caught and penalized accordingly. Read more about this case.

The I-9 is ever-changing and continues to be updated every few years. At a minimum, it is imperative to use the most recent Form I-9 mandated by USCIS and ensure that all sections of the I-9 are completed in a compliant and timely manner. Mitratech offers the only I-9 compliance solution to maintain a perfect 20+ year track record of zero client fines in federal and ICE audits.

How are Form I-9 penalties calculated?

In 2008, ICE issued a memorandum that required ICE agents to follow specific procedures for calculating I-9 related fines. The policy procedures are as follows:

- Use the number of violations of each type (paperwork, hiring or continuing-to-employ) as the numerator and the number of total employees as the denominator. For example, if you have 100 employees with 10 substantive paperwork violations and 20 hiring or continuing-to-employ violations, you’d have 10/100 = 10 percent for paperwork and 20/100 = 20 percent for hiring or continuing-to-employ violations, leading to a fine of $40,560 using the 2017 penalty matrices.

- The fines could then be adjusted up or down 5 percent for each of five factors—business size, good faith, seriousness, employment of unauthorized aliens, and prior history with ICE.

Further, ICE has begun adding the number of paperwork violations to the number of hiring or continuing-to-employ violations as the numerator, which can often increase the level of fine.

For example, if you have 100 employees with 10 substantive paperwork violations and 20 hiring or continuing-to-employ violations, you’d have 10 + 20 = 30 to calculate 30 percent violations, leading to a fine of $60,270, using the 2017 penalty matrices, according to SHRM.

Key I-9 misconceptions

1) Participation in E-Verify replaces the Form I-9. We don’t need to do both.

This is false. The E-Verify program does not replace the Form I-9 and participating in E-Verify does not remove an employer’s obligations to comply with the I-9 process. The I-9 is mandatory to all employers, while E-Verify is required for an employer if they are a Federal Contractor or employ people in certain states where state law mandates the use of E-Verify.

Other differences between the Form I-9 and E-Verify:

- I-9s are used for verifying identity and employment authorization while E-Verify is an internet-based system used to determine employment eligibility.

- SSN documentation is not required for the I-9, while E-Verify does require a SSN.

- An I-9 must be used to re-verify expired employment authorization while E-Verify may not be used for re-verification of expired employment authorization.

- I-9s are to be completed by both the employee and employer, while E-Verify is to be completed strictly by the employer or employer-authorized representative.

2) If I-9s are in an electronic system, this means the I-9s are fully compliant.

This is false. Whether you’re on an electronic system that is home-grown, provided as a standalone system, bundled into an onboarding package, or tied into an HRIS/ATS/HCM, it must still adhere and comply in accordance to the record-keeping standards that ICE requires. Ultimately, the responsibility for completing I-9s lies in the hands of the employer. Even with an electronic system, errors can easily loom in the system until exposed during an ICE inspection.

When evaluating I-9 vendors, it is critical to ask the right questions. Here are some suggested considerations as you evaluate electronic platforms:

- Does the I-9 vendor have a dedicated team of attorneys who inform product improvements? This is crucial.

- Who is the existing client base? Is the I-9 vendor able to produce references in the same industry and of the same employee size as your own company?

- How long has the vendor been in the market and how many of their clients have been audited? How many have received fines?

- Does the vendor allow for third parties to audit their system?

- Does the vendor document audit trails? This is required by ICE.

Since compliance is the central aspect of the Form I-9, every vendor should be able to showcase a history of successfully supporting clients through multiple federal audits. As evidenced by the Abercrombie & Fitch ICE audit, having an electronic I-9 system in place does not guarantee that ICE will give a company two thumbs up when it comes to compliance.

3) I-9s for a remote employee: Section 2 verification of the I-9 can be completed via video chat or by sending section 2 documentation via email.

This is false. Verifying Section 2 of the I-9 must be done in person by either the employer or its representative. It is not compliant to hire an employee without having the employer or employer representative view the documentation in the physical presence of the employee.

If using an advanced electronic I-9 management platform, employers may opt to use remote Section 2 features, such as Tracker’s I-9 Remote, to compliantly complete document verification anywhere in the United States.

5) I-9s are no longer needed after an employee has quit or has been terminated.

This is false. It’s absolutely critical that an employer retains I-9s for both current and ex-employees. The 3-year rule applies: I-9s must be kept three years from the date of hire or one year from the date of termination, whichever is later.

Common Form I-9 errors:

- Timeline of completion is ignored. USCIS maintains strict timeline requires that cannot be overlooked.

- Failure to complete both sides of the I-9. There are two sections that must be properly completed.

- Using White-Out. White-Out is never permitted

Common errors employees make:

- Failure to enter name, date of birth, or address.

- Failure to enter initial day of employment.

- Failure to indicate residency status.

- If employee chooses “Lawful Permanent Resident” they do not enter the USCIS number.

- If I-9 form was completed with the help of a translator, the employee fails to have the translator sign, print name, and date form.

Common errors employers make:

- Failure to enter the approved documentation on the I-9 form.

- Failure to submit Section 2 after the third business day of initial employment.

- Failure to enter the initial start date of employment.

- Failure to not enter the name, address, or title of the business.

- Using the incorrect/outdated version of the I-9 form.

- Asking employee for specific documentation on Section 2 – this is discrimination.

- Copying of documentation -the employer cannot discriminate; if the employer wishes to keep copies, he/she must make copies for all the employees.

- Employer incorrectly submits Section 3 after the employee has had his/her work authorization expire. They must request the documented evidence with the listed expiration date.

Retention of the Form I-9

Employers must be prepared to produce all Form I-9s in the event of an NOI. There are no specific legal restrictions to where and how an employer may choose to store their I-9s; however, it is recommended to avoid storing I-9 records in decentralized locations due to the difficulty of attaining those records in the event of a sudden audit. Common solutions include centralizing the process and uploading I-9s to a secure, cloud-based I-9 system.

Keep in mind that during an NOI, I-9 records requested can be those of employees who are currently employed, as well as terminated employees who fall within the termination retention period of USCIS’ rule: three (3) years from the date of hire or one (1) year from the date of termination, whichever is later.

The rule of thumb, therefore? Do not destroy an I-9 simply because an employee is no longer employed.

Other helpful resources?