Top 10 Most Common Form I-9 Mistakes

What does I-9 form mean? How can you identify common Form I-9 mistakes? The Form I-9 is a federally mandated, two-page document used for verifying the identity and employment authorization of individuals hired for employment within the United States.

Every employer is responsible for ensuring proper completion of the Form I-9 for all individuals hired for employment in the U.S. Once completed, employers must retain these forms for a designated period of time for the purpose of future inspections sanctioned by the U.S. government.

Despite only being two pages long, the Form I-9 has over 1,500 rules and is notably one of the more heavily regulated and audited federal forms in the United States. Due to the nature and subsequent complexities of the I-9, mistakes on behalf of both the employee and employer are common. If you’d like to gain a deeper understanding of the details of the I-9, read more about the Form I-9 here.

After processing millions of I-9s every year, we and Pearl Law Group have identified ten of the most common errors made on the Form I-9. Below, we’ll identify exactly where these common errors are made, and explore how to edit I-9 forms so they can be avoided.

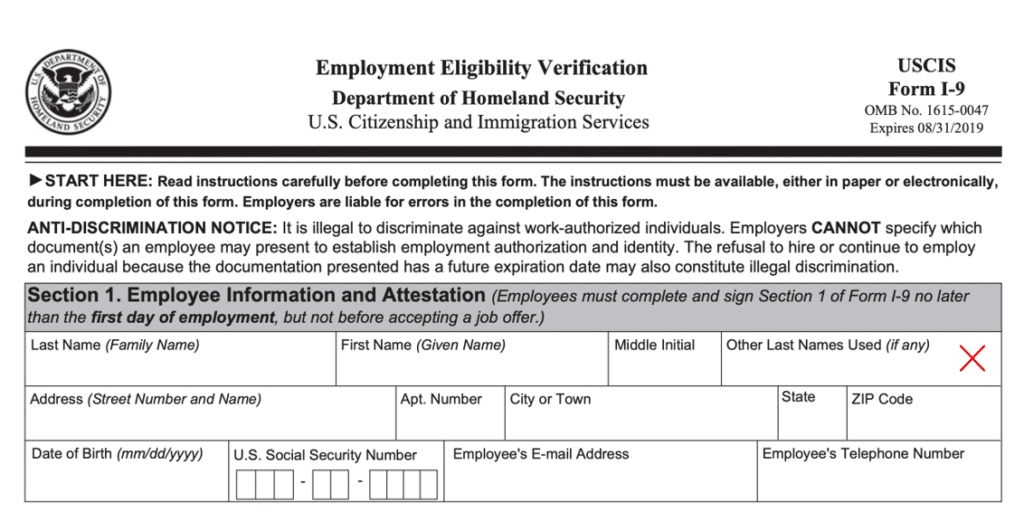

Section 1. Employee Information and Attestation

The Form I-9 can be a tedious step for employees before beginning a new job. New-hires will be excited about their new job opportunity, but will they be eager to complete the mountain of paperwork required during the onboarding process? The tedious Form I-9 is prone to mistakes made by both the employee and the employer.

In Section 1, employees often make the mistake of leaving blank I-9 fields. This is especially common if the employee interprets some fields to be optional.

For example, a common error in Section 1 occurs when a new-hire omits an entry for the “Other Last Names Used (If Any)” section. Leaving blank I-9 forms is not allowed and could be seen as grounds for fines; take ICE’s seven-figure fine to Abercrombie & Fitch due to a Section 1 error in A&F’s old electronic I-9 platform. Regardless of what employers use to manage I-9s, they should be certain that they input “N/A” if no other name applies in the “Other Last Names Used (If Any)” section of the I-9.

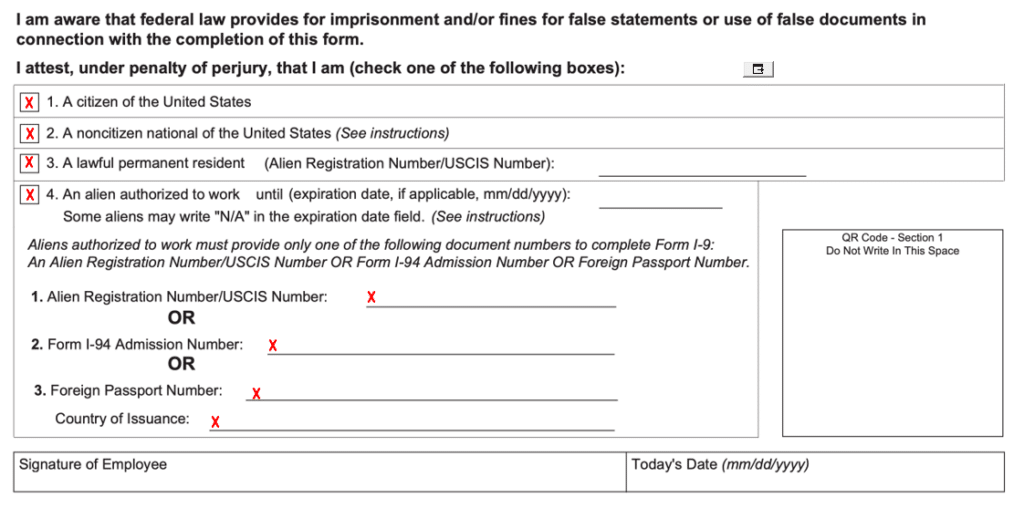

Another common mistake made in Section 1 occurs when a new-hire fails to select one of the four (4) new hire identification boxes (found on the left side of Section 1 below).

If an employee is a US Citizen, a noncitizen national of the United States, a lawful permanent resident, or an alien authorized to work, this status must be documented.

If the new-hire selects box number three (3) “lawful permanent resident” or number four (4) “alien authorized to work,” he or she must include the corresponding information.

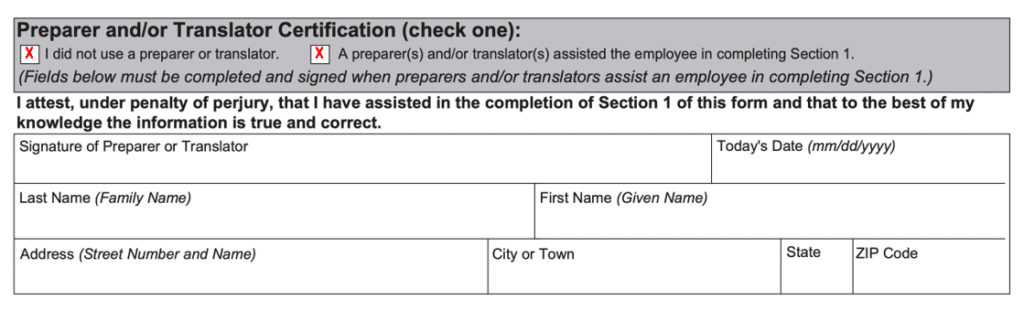

This is the same for boxes with the preparer and/or translator certification. An employee must check one (1) of the two (2) options; they cannot leave this field blank (see below).

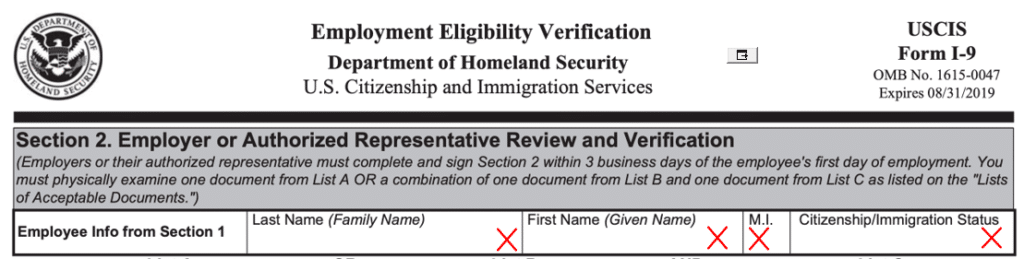

Section 2. Employer or Authorized Representative Review & Verification

Section 2 of the Form I-9 requires in-person employee ID verification. As always, the new hire’s identification documents must be reviewed in person by the employer or a designated Section 2 Approver who has been appointed by the employer.

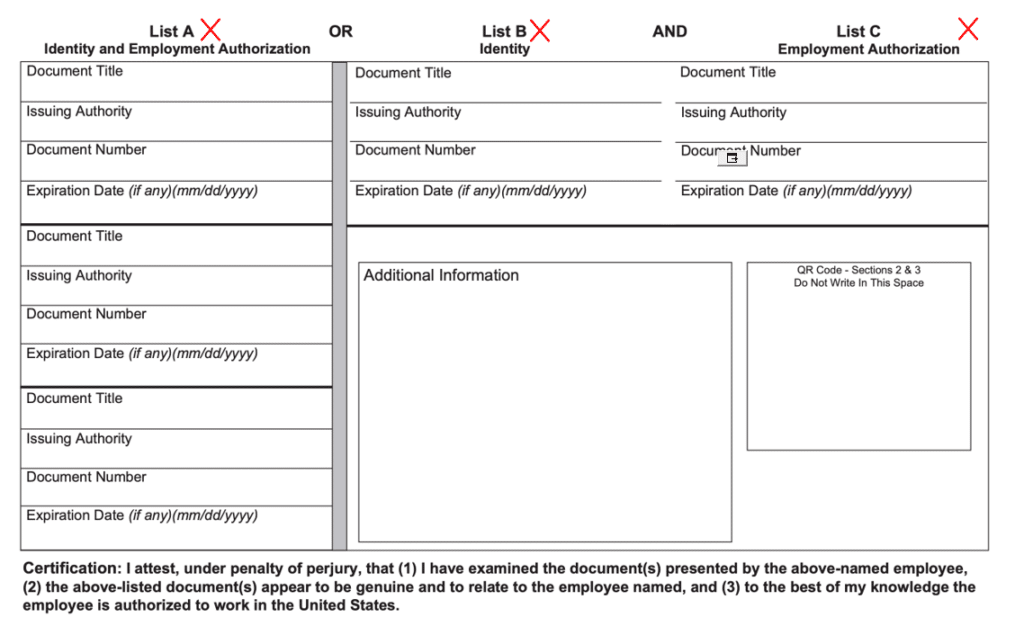

Most mistakes made in Section 2 are made in the document verification fields. After a recent analysis of 1.5 million Form I-9s, we found that over 50% of the I-9s analyzed had at least one error in this section. Paper forms, as opposed to electronic forms, are especially at risk of errors within the document verification fields. If your team is currently managing paper Form I-9s, you may be carrying significant liability and at risk of hefty audit fines.

This alarmingly high error rate of 50% is primarily due to the continuous increase of documentation that the U.S. Citizenship and Immigration Services (USCIS) & Department of Homeland Security (DHS) deem acceptable as new forms are updated every few years.

The key to Section 2 is remembering that one must choose a document from either List A (a single document like a passport) or a document from list B and list C (such as a driver’s license AND a social security card).

As an employer, be sure to avoid requesting specific documentation when asking a new-hire to provide documentation for verification. Doing so is seen as discriminatory and can leave an employer prone to potential scrutiny and workplace fines during an audit by federal labor and/or immigration agencies such as Immigrations and Customs Enforcement (ICE), USCIS, or DHS. The new-hire has full discretion over which documents he or she brings to the in-person meeting for review, provided the document appears to be genuine and relate to the new-hire, and must not be influenced by the employer.

It is up to the employee to read the instructions and decide which documents they would like to bring for verification. It is the employer’s responsibility to simply ensure that the employee brings the acceptable form(s) of documentation within three (3) business days of starting work for pay within the United States.

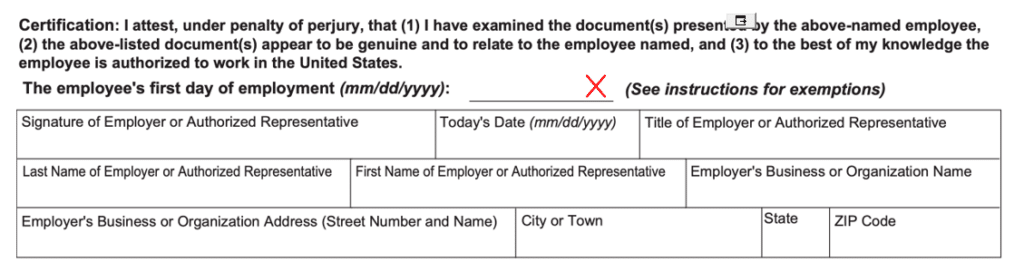

Employers must remember to complete all fields under the employer certification portion of Section 2. Be sure that you document the date on which the employee is first paid.

Finally, the first date the new-hire is paid for work, as documented within Section 2, must match the date documented in your payroll records, as ICE has full grounds to request Form I-9s, payroll records, business licenses, etc. during an Form I-9 audit.

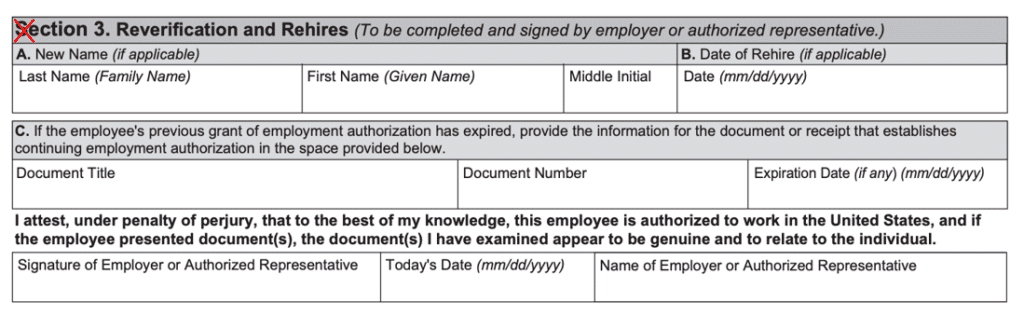

Section 3. Reverification and Rehires

Depending on when the original Form I-9 was completed for an employee being rehired, an employer may choose to create an entirely new Form I-9 or utilize Section 3 of the original Form I-9 created. If the rehiring process occurs less than three years after the original Form I-9 was completed, then the employer may choose to use Section 3 to document the rehire. For U.S. citizens, non Citizen Nationals, and most permanent residents, an employer should not ask the employee to present their List A or List C employment authorization document. Doing so could be considered discriminatory.

If the rehiring process occurs more than three years after the original Form I-9 was completed, a new Form I-9 must be created. In this scenario, an employee – regardless of citizenship status – must complete a new Form I-9 and present unexpired Section 2 ID document(s).

Finally, it’s very important that employers reverify foreign nationals with temporary work authorization before their work authorization expires.

Other mistakes impacting employers

Another common mistake is inconsistent document retention. All too often, employers forget to purge Form I-9 records after employees have left the company and have passed the statutory retention period.

USCIS’ ruling for proper Form I-9 purging is known as the 1 year 3 year rule. When employment ends, employers must retain the Form I-9 for three years after the employee’s first day of work for pay or one year from the date of termination, whichever is later.

Remember, even if the employee resigned or was terminated, employers are still liable for mistakes on the employee’s Form I-9. The suggested practice here is self-audit and a Form I-9 remediation process.

Finally, when it comes to retaining images of the employee’s work authorization and identity document(s) there are important factors to keep in mind:

- First, employers who E-Verify must retain certain types of list A documentation (e.g. U.S. Passport) under Section 2 of the I-9. These List A documents fall under the E-Verify Photo Match rule, in which the employer must verify that the image presented in the E-Verify system matches the image on the document provided by the employee. Retaining a Photo Match document is not optional if the employer participates in E-Verify.

- Second, an employer may choose to retain images of all employee documents (both for Section 2 and Section 3). If an employer chooses to retain copies of all documents for one or some employees, that employer must do so for all employees. Inconsistency (e.g. retaining document for foreign nationals, but not U.S. Citizens) can be viewed as discriminatory and puts the employer at risk of investigation and potential fines.

- Third, keep in mind that employers do not need to make copies of I-9 documentation during section 2 completion of the I-9 if they do not participate in E-Verify. Nevertheless, employers or employer-designated approvers are still required to examine documentation presented by a new hire for authenticity.

The Form I-9 is complex. Choosing the right electronic management partner is a crucial component in any team’s compliance process and the most important step to eliminating costly mistakes.”

How to Avoid Making Form I-9 Mistakes

Filling out Form I-9 correctly is essential for both employers and employees. By avoiding common mistakes, you can ensure compliance with the law and prevent unnecessary complications. Here are some tips to help you avoid making Form I-9 errors.

1. Familiarize yourself with the instructions: Take the time to understand the requirements outlined in the form’s instructions before starting. This will provide clarity on what information needs to be provided and how it should be documented.

2. Use the most current version of the form: USCIS periodically updates Form I-9, so make sure you’re using the latest version available on their website. Using outdated forms could lead to inaccuracies or rejections.

3. Complete all sections accurately: Each section of Form I-9 serves a specific purpose, so ensure that every field is completed accurately and in its entirety. Leaving any part blank can result in non-compliance.

4. Verify documents properly: When verifying an employee’s identity and employment authorization, carefully examine their original documents as required by the form’s instructions. Incorrectly accepting or rejecting valid documents can lead to legal issues.

5. Retain records appropriately: Maintain copies of completed Forms I-9 according to federal guidelines – store them securely and separately from personnel files while ensuring easy accessibility for inspections if needed.

6. Train your staff: Educate key personnel involved in completing Form I-9 about proper procedures, including HR representatives or anyone responsible for hiring new employees within your organization.

7. Self-audits regularly: Conduct regular self-audits of your company’s Forms I-9 practices to identify any potential errors or areas for improvement proactively.

8. Seek professional assistance if needed: If you find navigating through immigration rules challenging or have complex scenarios (remote workers), consider seeking guidance from an immigration attorney or experienced HR consultant specializing in immigration compliance matters.

By following these tips, you can minimize the risk of making Form I-9 mistakes.

Human Resources Solutions

Power Faster, More Compliant Hiring for an Ever-Changing Workforce