How Can CFOs Escape the Spreadsheet Spiral?

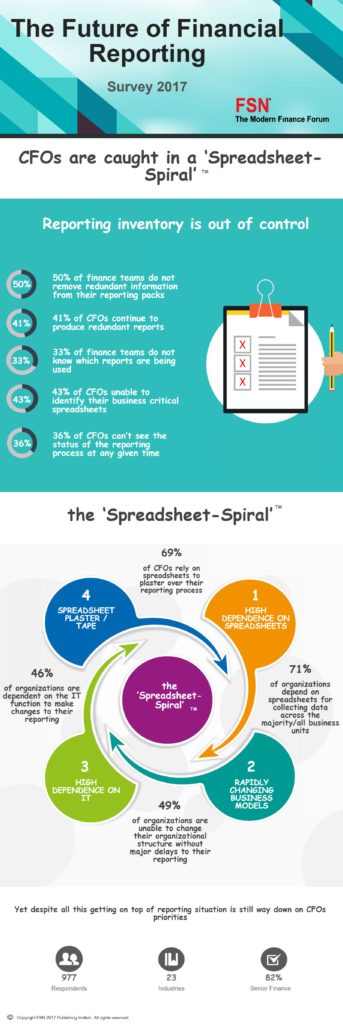

Three years on, the findings of research by FSN Modern Finance Forum, entitled The Future of Financial Reporting Survey 2017, potentially still hold true today.

CFOs are caught in a spreadsheet spiral, and it seems that they are unable to find a way out of it. This is greatly impacting – and even exacerbating – the challenges that finance departments face in meeting the reporting demands from internal and external authorities.

The research found a high dependency on spreadsheets, with 71% of organizations using the tool to collect data across business units. But of course, given the volatile economic environment and evolving regulatory landscape, finance departments often need to develop new or change existing business models.

Most businesses deploy sophisticated enterprise systems, but these technologies can’t deliver against the agility demands of the organization due to their complexity.

46% of organizations today are dependent on the IT function to make amends to their reporting structures in these enterprise systems. This causes delays, leaving CFOs with no option, but to resort to spreadsheets to fill the functionality gap and use these end-user computing (EUC) applications to plaster over the reporting processes. This cycle continues endlessly.

The financial reporting process keeps 97% of CFOs awake at night, with 62% of finance teams concerned that they will not meet their reporting deadlines. To counterbalance the impact of shrinking resources, CFOs are turning to self-service reporting, ranking it as their number two technology priority after automated document production and electronic signatures.

A lack of controls and visibility

The rationale behind self-service reporting is understandable, but the notion is fraught with risk due to the ‘spreadsheet spiral’ phenomenon gripping financial departments. Spreadsheets are used for a wide variety of financial processes, data manipulation, and aggregation, with multiple information sources feeding into these applications. The problem with unstructured and uncontrolled use of spreadsheets is that it becomes difficult to guarantee the accuracy of data residing in these applications.

Definitive policies and controls around spreadsheets usage are lacking in many organizations; consequently, there is a lack of visibility of the data lineages and interconnections among spreadsheets and other EUC files. This greatly increases the risk of the use of these tools for precise financial reporting, as typically anyone can create a new business-critical financial process, with no checks and balances to ensure accurate data usage in the model.

CFOs must have confidence in their data. They must know the exact data sources that feed into their financial reports – and their providence. The reality is that many finance departments don’t have visibility into data flows across their spreadsheet and EUC landscape. The data links between the different spreadsheets across departments, regions, and models are routinely undocumented and so impossible to view and accurately decipher. 40% of CFOs are unable to agree that their data is always trustworthy; 46% of them worry about an unexpected spreadsheet error being identified.

The repercussions could be significant, since when it comes to financial reporting and results, they are individually answerable. The Marks and Spencer debacle, when the company inadvertently issued inaccurate financial results due to a spreadsheet error, is just one such example. A single error in a spreadsheet can create a domino effect, creating data anarchy and potentially invalidating the accuracy of financial models and reports, putting the business at extreme operational risk.

The repercussions could be significant, since when it comes to financial reporting and results, they are individually answerable. The Marks and Spencer debacle, when the company inadvertently issued inaccurate financial results due to a spreadsheet error, is just one such example. A single error in a spreadsheet can create a domino effect, creating data anarchy and potentially invalidating the accuracy of financial models and reports, putting the business at extreme operational risk.

And yet, CFOs can’t extricate themselves from the spreadsheet spiral – this is because of just how embedded spreadsheets are in the finance function. CFOs need to get their house in order, however, and the solution genuinely lies in technology adoption. Manually trying to decode the data lineages across a vast EUC environment is a futile and indeed impossible task.

Why automation is the answer

Automation can break the spreadsheet spiral that is challenging many CFOs and their finance departments. By adopting technology, finance departments can institute end-to-end control of spreadsheets across their lifecycle, transparency around their data and data lineage – from creation through to decommissioning. Additionally, they can ensure that the business-critical processes residing in spreadsheets are appropriately incorporated into the core enterprise systems at the right time, based on organizational policies and regulatory requirements. This approach helps maintain ‘one version of the truth’ at all times across the entire business.

The abovementioned research also highlights how 75% of CFOs are yet to make the move to real-time reporting in the Boardroom. For this, indisputable information accuracy and complete visibility of the spreadsheet universe and transparency of lineages across the data landscape is essential – and technology can deliver this. Finance departments will be able to manage every single spreadsheet and EUC application across its lifecycle routinely and based on best practice. It will also help make CFOs’ goal of self-service financial reporting an achievable reality…and help them break out of the downward spiral that’s threatening their businesses and peace of mind.

Via Workday

Discover PolicyHub

It's the Policy Management solution that’s easy to use, so you can build stronger compliance.